Latest PolicyX Price Index Reveals Stability In Health & Term Insurance And Urges Youngsters To Invest In One Soon

The PolicyX price index is updated each quarter after evaluating both health and term insurance prices from company stalwarts of the insurance industry.

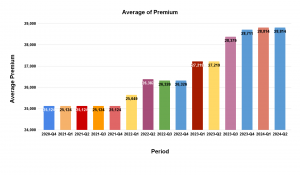

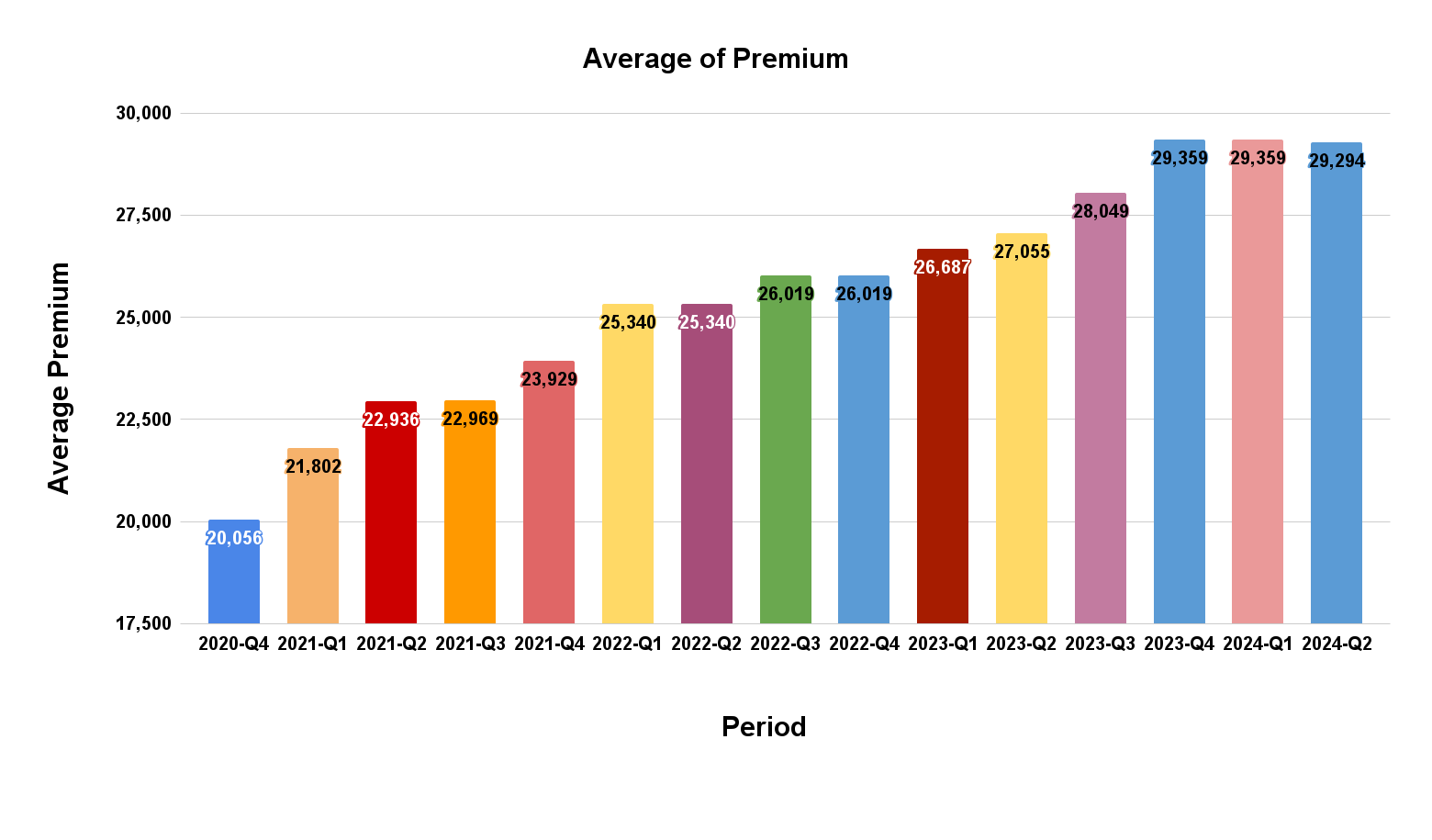

GURUGRAM, HARYANA, INDIA, July 12, 2024 /EINPresswire.com/ -- As per PolicyX.com price index data, the health insurance sector has seen stability in product prices (Q1 and Q2 2024). A very welcoming change given the generally high inflation rates in the economy. However, we have seen a slight drop in term insurance prices in Q2, thanks to discounts now offered by some leading insurers. This stagnancy is a huge sigh of relief for current policyholders and people who are looking to buy health/term insurance soon.Referring to the Price Index data by PolicyX.com, in the last 4 years health insurance has faced a lesser hike in average premium than term insurance. In 2024, the avg. premium of health is INR 28,814, 14.7% more than the avg. premium of INR 25,124 in 2020. Similarly, in 2020, the avg. premium in term insurance was INR 20,056. It increased to INR 29,294 in Q2 2024: a whopping hike of 46.1%!

On the contrary, it has been quite eventful in terms of insurance regulations and striking product launches. The National Health Authority has created the National Health Claims Exchange (NHCX), a one-stop platform for insurers and consumers for quick claim settlement. Also, IRDAI has recently launched a master circular to bring in positive changes in the insurance sector. The master circular offers a reduction in policy cancellation charges and no claim rejection without the approval of the Claims Review Committee.

Alongside, new product launches have also grabbed the attention of insurance consumers. On 1 July 2024, Narayana Health Insurance announced its entry into health insurance with the launch of a health plan ‘ADITI’. It offers a high sum assured of Rs 1 Crore for surgical procedures. The Indian Olympic Association (IOA) has recently proposed a new program to support former Olympians by providing medical insurance and a pension for all. The best for last, ICICI Lombard has launched a new health insurance plan called ‘Elevate’ which uses artificial intelligence technology. A first of its kind, the AI technology can potentially analyze the health of the customer and offer them a more customized plan.

PolicyX has been a trusted and popular name in the insurance industry for the past 10 years. The availability of the Health Price Index and Term Price Index on PolicyX.com adds to the brand's motto of honesty and 100% transparency. The price index is updated each quarter after evaluating both health and term insurance prices from company stalwarts of the insurance industry. You can easily access the price index of both health and term insurance for factual information, price comparison of past quarter/s, and key insights into the Indian insurance industry.

Key Insights of Health Insurance (Q4 2024):

Buying health insurance with a higher sum insured is much more profitable compared to one with lesser SI from the consumer’s point of view. For example, for an individual policy of 10 lakh SI, the premium will be approx. INR 35,718, whereas for the same policy with INR 5 lakh SI, the premium will be INR 27,944. So, just by paying around INR 7,774 more, the individual can get coverage of 2X SI!

Similarly, going for a combined plan will cut down on expenses. Let us understand this with a simple example.

Let’s say, that for a 26-year-old adult with 5 lakh coverage, the premium is INR 9,499. When 2 adults buy separate plans, the combined premium cost will be INR 18,998 which is much higher. Instead, it’s better to buy a family floater/multi-individual policy for an average premium of INR 14,311 for both of them.

Clearly, Q2 2024 is the ideal time to invest in a comprehensive and high sum insured health insurance plan for increased coverage at a nominal extra cost.

Key Insights of Term Insurance (Q4 2024):

Similar to the health insurance update, not purchasing term insurance at a younger age ensures significantly higher premiums. Delaying a term insurance purchase for 10-years results in an increased premium of approx. 53.20% for a 25-year-old, approx. 78.83% for a 35-year-old, and around 78.01% for a 45-year-old.

In the latest quarter, we can see a gender-based gap in premiums. In India, males face a 22.02% higher premium compared to females, highlighting the right opportunity for more females to invest in a term plan.

Being a non-smoker is highly beneficial as they have to pay lower premiums due to their reduced risk profile. For example, a smoking female purchasing a term insurance policy with a sum assured of INR 1 crore pays approximately 75% higher premiums compared to a non-smoker. For males, the premium differential is approximately 73% higher for smokers.

This Q2 2024, 60% of term insurers have impressively maintained their premium rates, and the remaining 40% of insurers have experienced fluctuations. Compared to 2020, this new quarter of 2024 ushers in much-needed stability in this sector. Now is the perfect time to buy term insurance with exclusive features at an affordable rate, thanks to the discounts offered by many leading term insurance companies.

Keeping in mind the latest developments in both the insurance sectors, Naval Goel, CEO and Founder at PolicyX.com said, "There have been a slew of positive developments in terms of the regulatory environment for both the health and life insurance industry. These changes are expected to increase the penetration of insurance and create awareness since most of these changes are beneficial for consumers in general. We expect the price of these products to remain more or less stable going forward."

About PolicyX.com:

PolicyX is the most trusted name with 10+ years of experience in the Indian insurance market. The sole aim is to provide insurance knowledge, products and end-to-end services to its customers relying on factual information, transparency and honesty. Certified by IRDAI, the PolicyX website offers the latest and best insurance plans related to health, term, and life. From comparing insurance premiums via the revolutionary premium calculator to understanding the value of additional benefits in detail - every crucial information is easily available and trustable with PolicyX.

Anchita Bhattacharyya

PolicyX.com

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Insurance Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release