Collin County Homeowners Should Consider Appeal Options For 2024 Appraisal Values

O'Connor concludes that Collin County homeowners should consider 2024 appraisal value appeals.

DALLAS , TEXAS , UNITED STATES , May 15, 2024 /EINPresswire.com/ -- Collin County Witnessed a Nearly 6.5% Surge in Home Valuations

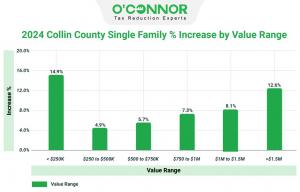

This is shocking news! Property tax assessments increased by over 15%, from $2.1 billion to $2.4 billion, for homes in Collin County valued at less than $250,000. The lowest rise, however, was in the value category for homes worth between $250,000 and $500,000, with a mere 4.9% increase. In 2024, the Collin County Appraisal District increased the assessed value of single-family homes by 6.5%.

Regardless of house size, Collin County’s real estate market had a significant upturn in 2024, with property values growing by 6.5% to a total value of $188 billion from $176 billion. Larger than 8,000 square foot homes had an especially notable 14% increase. Although they experienced an average 5.5% gain, houses under 2,000 square feet had the least amount of increase out of all the home size groups.

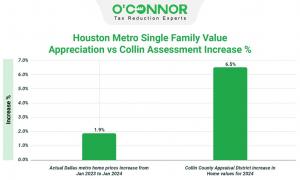

Collin County’s Single-Family Home Values Saw an Increase Compared to the Assessments in the Dallas Metro area.

Following the 2024 property tax reassessment in Collin County, the Collin County Appraisal District reportedly increased home values by 6.5%. However, the increase in Dallas Metro property values from January 2023 to January 2024, as reported by the Metro Tex Association of Realtors, only reached 1.9% over previous sales.

Collin County Property Taxes Determined by Construction Year

Home assessments in Collin County were reevaluated in 2024, and the largest increase was 9% for properties constructed before 1960. The smallest increase was 3.4% for homes built between 1981 and 2000. Home values by year of construction increased by 6.5%, providing some interesting data on the county’s property fluctuations.

In 2024, the Collin County Appraisal District accurately or slightly overestimated the value of 10,612 residential accounts, constituting 72% of the total, while 4,083 accounts (28%) were overvalued. This research delves into the accuracy of property assessments by scrutinizing the sales prices of residences in 2023 against their 2024 property tax reassessment values.

Overview of Collin County’s 2024 Property Tax Revaluation by the Appraisal District

Collin County property owners are seeing substantial rises in residential property prices, surpassing the recorded growth rates in the Dallas metro area. Although residential real estate has generated significant profits, the situation in residential real estate has varied, with some areas showing positive developments while others are facing decreases. A significant number of homeowners admit the decrease in the value of their residential properties in recent years, which may be partially ascribed to the rise in interest rates from 1.71% in January 2022 to 4.05% in January 2024. This position is also impacted by the consistent revenue patterns as well as the ongoing increases in casualty insurance and other operational costs.

Appeal Your Property Values Each and Every Year

Property owners in Texas, especially those in Collin County, have the legal right and are encouraged to challenge the assessed value of their land. Whether residential or commercial, owners can present evidence during the appeal process to argue against an excessive assessment. It’s advisable for owners to consider filing an appeal or enlisting the help of a property tax consulting firm, as many protests result in favorable outcomes. With over five decades of experience, O’Connor is well-equipped to advocate for property owners’ rights. Moreover, O’Connor is committed to supporting property owners by effectively reducing taxes at a reasonable cost, utilizing their extensive resources for this purpose.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.