Zinger Key Points

- SoFi Technologies has enjoyed a strong rebound following significant market chaos.

- Amid the rising VIX “fear gauge,” SOFI stock risks running into eventual upside resistance.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Amid the drama surrounding President Donald Trump's trade war — particularly the recently announced and subsequently heavily mitigated Liberation Day — it's easy to lose sight of another worrying headline: the rising of the CBOE Volatility Index or VIX. Commonly referred to as the "fear gauge," the VIX has spiked sharply earlier this month, presenting concerns for risk-on, consumer-sensitive financial technology outfit SoFi Technologies Inc SOFI.

Here’s the deal fundamentally. Under broader bullish conditions, SOFI stock would seem a bold but very rational wager. Lending activity may rise, particularly among students and young workers. Further, there may be a greater willingness to enter personal loans as well as home mortgages. As stocks rise, there may be greater participation in financial services, such as investing and banking. All told, confidence in the economy represents one of the key linchpins of said activities.

Now let's consider the present circumstances. The VIX, which is technically a measure of expected volatility based on the pricing behaviors of S&P 500 option premiums, reflects uncertainty of the market's forward trajectory. That's because the pricing dynamics of the aforementioned derivatives indicate a willingness by traders to pay more to hedge. That's not confidence in the economy, which may spell upside challenges for SOFI stock.

Many experts will be quick to point out that the VIX is a contrarian indicator — and there are certainly compelling statistics to back that up. However, it's critical to note that the VIX is a reflection of S&P 500 option pricing, not a driver. Plus, the blistering rise of gold adds worrying, if not dangerous context to the VIX.

Let's face it — if people are hoarding gold on commercial jets, they're probably not buying SOFI stock or any other growth-oriented enterprise.

Creating a Zero-Parallax Wager in SOFI Stock

To be sure, recognizing broader warning signs is one thing; crafting a compelling trade to extract profits from the speculation is quite another. Notably, predicting a security's future price is extremely difficult to accomplish because it's not just a matter of direction but also of magnitude and time. This three-dimensional concept falls prey to the market's equivalent of parallax error.

In shooting sports, parallax refers to the optical illusion of the reticle or crosshairs appearing to be on target, only to discover a misalignment between perceived projection versus where the fired shots actually landed. It's a similar situation with stocks and especially options trading: while a bullish or bearish thesis over a defined time period may appear compelling, if magnitude doesn't cooperate, the trade may be toast.

One of the most straightforward ways to mitigate some of the uncertainty in options trading is through zero-parallax wagers. These trades structure transactions in such a way that it effectively eliminates the magnitude component from the probability equation, thus turning a stochastic calculus problem into a simple algebraic one.

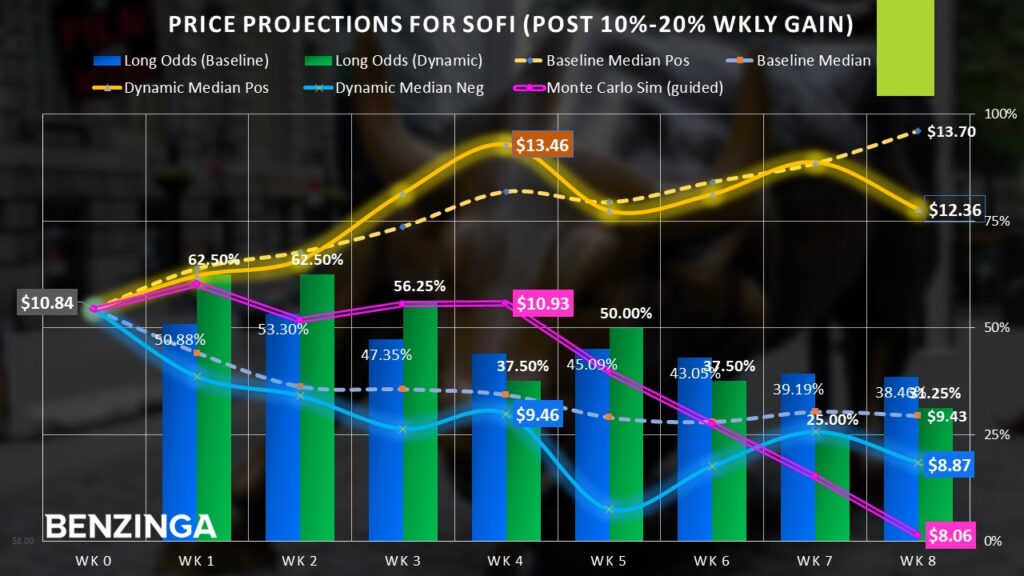

Indeed, through a simple rise-over-run equation, traders can empirically calculate the probability of forward behavior of SOFI stock. Essentially, SOFI enjoys a slightly upward bias in early weeks. But as time passes, the likelihood of a long position rising diminishes, thus favoring the bears. Under zero-parallax conditions, the magnitude doesn't matter; just the direction and time.

Under certain dynamic conditions, SOFI's forward negative trajectory becomes even more exaggerated. In the past five sessions, the equity gained over 15%. During times when SOFI returned between 10% and 20% in a one-week period, the next three weeks have featured above-average long odds. But in the fourth week following the extreme-greed event, the odds of a long position held for that time fall to 37.5%.

Turning a Multivariate Concept into a Straightforward Deduction

Bold traders who are reading the headlines and doing the math may want to consider the 11.50/11.00 bear put spread for the options chain expiring May 9, which is basically four weeks out. Statistically, the odds that SOFI stock will rise four weeks in that time period is only 44.2%. And since the current market price of $10.84 is about 1.45% below the short strike price — making the trade technically risk inverted — this barrier must be accounted for.

Doing the math, there's only a 41.5% chance that SOFI stock four weeks from today will be profitable. That's a straight moneyline bet without the parallax error of magnitude to consider.

To initiate this trade, one would buy the $11.50 put (at a time-of-writing ask of $138) and simultaneously sell the $11 put (at a bid of $107), resulting in a net debit paid of $31. Should SOFI stock "fall" to the short strike price of $11 at expiration, the maximum reward is $19, a payout of 61.29%.

Of course, since SOFI is currently below $11, the equity is already where it needs to be. Again, this is also risk inversion at play, where theta (or time decay) works in favor of the debit buyer. Irrespective of one's long-term feelings about SoFi, the empirical framework makes the above trade incredibly tempting.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.