This large NBFC could gain big from a rate cut – and it’s not Bajaj Finance

Since 2013, Cholamandalam Finance’s EPS has grown from Rs 0.5 to Rs 41, and its return on equity has remained above 15%. The company has posted an impressive 5-year CAGR of 23% in AUM and 30% in pre-tax profits. But can this stellar performance continue?

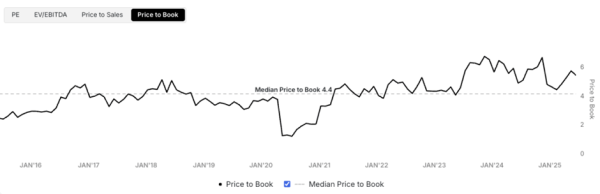

Back in March 2020, during the Covid lockdown, Cholamandalam was trading at 1.8X price-to-book value. Today, it trades at a princely 5.75X. (Photo: FB)

Back in March 2020, during the Covid lockdown, Cholamandalam was trading at 1.8X price-to-book value. Today, it trades at a princely 5.75X. (Photo: FB)They say all good things must come to an end — unless you’re Cholamandalam Finance.

Over the past 15 years, the company has expanded its branch network from 170 to 1,400. Earnings per share (EPS) grew from Rs 0.5 to Rs 41, and return on equity (ROE) has remained above 15% since 2013. The company has posted an impressive 5-year compound annual growth rate (CAGR) of 23% in assets under management (AUM) and 30% in pre-tax profits.

The stock price return at 53% CAGR has exceeded profit growth during the same period.

Source: http://www.tradingview.com

Source: http://www.tradingview.com

So the obvious question is: Can this stellar run continue?

A ‘Goldilocks’ moment

Back in March 2020, during the Covid lockdown, Cholamandalam was trading at 1.8X price-to-book value. Today, it trades at a princely 5.75X.

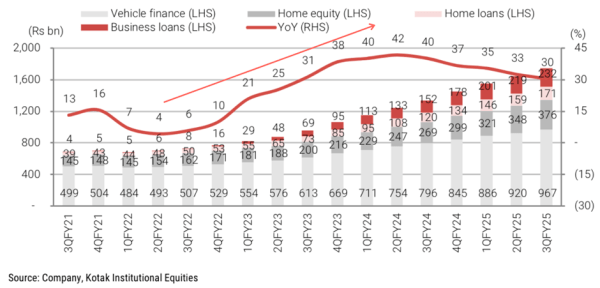

Call it Cholamandalam’s ‘Goldilocks’ moment. Between September 2022 and September 2024, AUM growth sharply rebounded, accompanied by declining credit costs. EPS grew at a 24% CAGR. Thanks to a combination of valuation re-rating and EPS growth, the stock returned 53% CAGR over five years, compared to 12.4% CAGR for the NSE Nifty over the same period.

Source: Kotak Institutional Equities

Source: Kotak Institutional Equities

It’s important to note that the twin engines of valuation re-rating and EPS growth, which supported a stellar run, are unlikely to continue playing out, especially the former.

The EPS growth is expected to remain robust, with management guiding for a 25% AUM growth for FY26. But where will this growth come from?

Diversified loan mix = calibrated growth

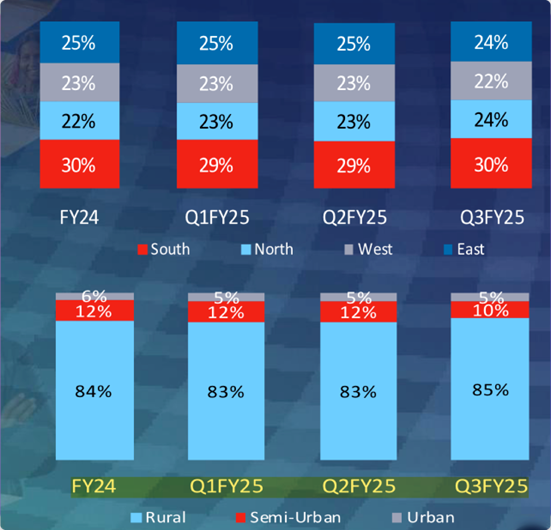

As of Q3 FY25, Cholamandalam operated 1,577 branches, 91% of which are in Tier-3 to Tier-7 towns. Its geographic spread is balanced, with South India contributing 30% and the remaining 70% equally divided among the North, West, and East. It’s a classic example of a large diversified NBFC and the benefits that come with it.

Source: Cholamandalam Investment & Finance company, Q3FY25 Investor presentation

Source: Cholamandalam Investment & Finance company, Q3FY25 Investor presentation

Cholamandalam has been a commercial vehicle financier since its inception in 1979. However, over time, it has diversified into five other segments – Loan Against Property (LAP) (in 2006), home loans (2013), consumer loans (2022), SME loans (2022), and secured business and personal loans (2022).

This diversification allows the company to calibrate growth in segments that appear promising. This is exactly the rationale for the merger of Shriram Finance, the largest player in the CV financing business. Shriram’s lost decade was the Cholamandalam opportunity.

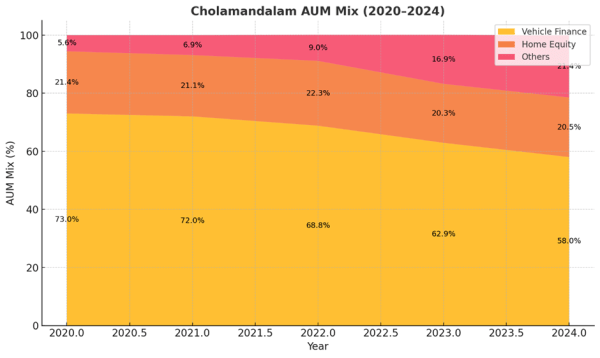

Interestingly, despite solid growth, the share of vehicle finance in the total mix has been steadily declining over the last five years.

Source: Cholamandalam Investment & Finance company, Q3FY25 Investor presentation

Source: Cholamandalam Investment & Finance company, Q3FY25 Investor presentation

In FY25, however, vehicle finance growth has moderated due to muted growth in auto sales. However, this segment includes multiple sub-categories — LCVs (Light Commercial Vehicles), HCVs (Heavy Commercial Vehicles), used cars, and CVs (commercial vehicles). So, a slowdown in the segment overall does not mean all segments within vehicle finance are slowing down.

So, while the overall segment is expected to grow at around 20%, used CVs and cars continue to grow at 24-32%.

Home Loans and LAP to support growth

The 25% AUM growth will depend on non-vehicle finance segments – home loans and LAP. These now make up about 35% of the AUM and are expected to grow 35-41%, according to a Kotak Institutional Equities Feb 1, 2025 report.

New Business segments seeing elevated stress

The ‘other’ segments — comprising small business loans — have increased from 2% to 12% since 2022. However, this segment is witnessing elevated stress as loans due more than 90 days have increased from 1.1% to 1.9% over the last one year.

The management attributes most of the stress to the Consumer and Small Enterprise Loans (CSEL), particularly those originating through fintech and third-party partners. Disbursements from these partnerships have been intentionally curtailed, dropping from 33% to 9%. These small-ticket loans are expected to run off over the next 1–2 years.

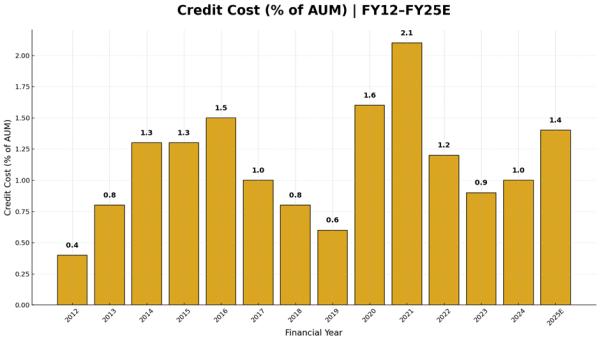

Credit costs

Protracted recovery in the vehicle finance business and the long-drawn SARFESI process in LAP will likely lead to elevated credit costs of 1.5% in FY2026E, which is above the normalised 1-1.2% level. SARFAESI is a law that allows banks and NBFCs to recover loans by selling the borrower’s assets — like property — without going to court.

Despite this, the overall return on equity is expected to remain healthy at around 19%.

Source: Kotak Institutional Equities

Source: Kotak Institutional Equities

Rate cut: A blessing

44% of Cholamandalam’s borrowings are in floating-rate bank loans, while 56% of the vehicle finance loan book is fixed-rate. As rate cuts get passed through, the company is likely to witness an improvement in Net Interest margins (NIMs). Higher NIMs mean higher profits, all else remaining equal.

Valuation

There is a high degree of robustness built into Cholamandalam’s diversified business model. The business has grown consistently for 15 years through various business cycles and interest cycles and yet has maintained a healthy ROE and growth.

Even in a “bear case” scenario, the company is expected to perform well.

However, valuations based on price-to-book values are towards the upper end. While data from Tijori only accounts for shareholders’ equity until September, if we look at the data from Cholamandalam’s Q3 investor presentation, price-to-book value is lower at 5.3x instead of 5.7x in the chart below.

Source: http://www.tijorifinance.com

Source: http://www.tijorifinance.com

The “Goldilocks” period for Cholamandalam’s stock is likely over. The price returns witnessed from FY20 to FY25 are unlikely to sustain despite a projected 25% EPS growth.

Cholamandalam remains an exceptional business at a premium valuation. Additionally, the return of a big competitor — Shriram Finance — which has absolved itself of the legacy issues, is likely to put competitive pressure. Under such circumstances, expecting the past five years’ returns to repeat could be overly optimistic.

Only time will tell how the company performs on the bourses.

Note: We have relied on data from http://www.Screener.in and http://www.tijorifinance.com throughout this article. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

Rahul Rao has helped conduct financial literacy programmes for over 1,50,000 investors. He has also worked at an AIF, focusing on small and mid-cap opportunities.

Disclosure: The writer or his dependents do not hold shares in the securities/stocks/bonds discussed in the article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

Apr 18: Latest News

- 01

- 02

- 03

- 04

- 05