Across the recent three months, 10 analysts have shared their insights on Travelers Companies TRV, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 3 | 3 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 3 | 2 | 0 |

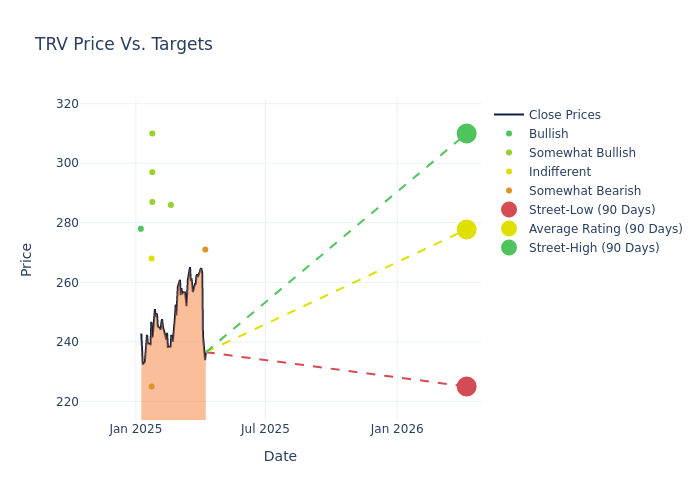

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $270.0, with a high estimate of $310.00 and a low estimate of $213.00. This current average reflects an increase of 4.21% from the previous average price target of $259.10.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Travelers Companies by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|-----------------------|---------------|---------------|--------------------|--------------------| |Jimmy Bhullar |JP Morgan |Raises |Underweight | $271.00|$260.00 | |Meyer Shields |Keefe, Bruyette & Woods|Raises |Outperform | $286.00|$275.00 | |Meyer Shields |Keefe, Bruyette & Woods|Raises |Market Perform | $275.00|$268.00 | |Paul Newsome |Piper Sandler |Raises |Overweight | $310.00|$259.00 | |Michael Zaremski |BMO Capital |Raises |Outperform | $297.00|$275.00 | |Alex Scott |Barclays |Raises |Overweight | $287.00|$278.00 | |Scott Heleniak |RBC Capital |Lowers |Sector Perform | $268.00|$273.00 | |Elyse Greenspan |Wells Fargo |Raises |Underweight | $225.00|$213.00 | |Elyse Greenspan |Wells Fargo |Lowers |Underweight | $213.00|$217.00 | |Meyer Shields |Keefe, Bruyette & Woods|Lowers |Market Perform | $268.00|$273.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Travelers Companies. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Travelers Companies compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Travelers Companies's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Travelers Companies's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Travelers Companies analyst ratings.

Get to Know Travelers Companies Better

Travelers offers a broad product range and participates in both commercial and personal insurance lines. Its commercial operations offer a variety of coverage types for companies of any size but concentrate on serving midsize businesses. Its personal lines are roughly evenly split between auto and homeowners insurance.

Travelers Companies's Financial Performance

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, Travelers Companies showcased positive performance, achieving a revenue growth rate of 9.85% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Travelers Companies's net margin excels beyond industry benchmarks, reaching 17.2%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Travelers Companies's ROE stands out, surpassing industry averages. With an impressive ROE of 7.44%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Travelers Companies's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.54%, the company showcases efficient use of assets and strong financial health.

Debt Management: Travelers Companies's debt-to-equity ratio stands notably higher than the industry average, reaching 0.29. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.