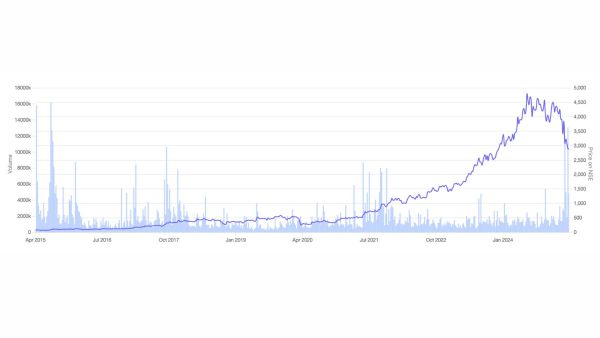

3,600% returns from 2015-2025: Can KEI continue its dream run?

From Rs 2,000 crore revenue in FY15 to over Rs 8,000 crore today, KEI compounded its way into investor portfolios and sector leadership. But as we step into 2025, the story is changing. New entrants with strong financial resources and access to raw materials are entering the wires and cables space. So here’s the big question: Can KEI sustain its momentum?

What’s important to understand is that KEI’s stock price today reflects belief in both its earnings growth and margin stability. (Credit: Pexels)

What’s important to understand is that KEI’s stock price today reflects belief in both its earnings growth and margin stability. (Credit: Pexels)From 2015 to 2025, KEI Industries delivered a staggering 3,600% return.

Rs 1 lakh invested a decade ago would be worth over Rs 36 lakh today. All of this is from a business that sells wires and cable products that hide behind walls, but now sits front and centre in India’s infrastructure and real estate boom.

KEI’s rise has been a textbook story of market understanding, brand building, and relentless execution. From institutional supply to becoming a retail force, from Rs 2,000 crore revenue in FY15 to over Rs 8,000 crore today, KEI compounded its way into investor portfolios and sector leadership.

But as we step into 2025, the story is changing. The Adani Group and Aditya Birla Group — two of India’s most aggressive conglomerates — are entering the cables business. Backed by capital, distribution networks, and access to raw materials, they could shake up what was once a four-player race.

So here’s the big question: Can KEI continue its dream run, or is the competitive voltage about to spike?

KEI Industries Ltd Share Price Chart (Apr’ 15 till Apr ‘25)

Figure 1: Stock price movement of KEI Industries Ltd. Source: Screener.in

Figure 1: Stock price movement of KEI Industries Ltd. Source: Screener.in

Wiring India’s growth: Inside KEI’s business, scale, and moat

To make sense of where KEI is headed, you first need to understand what it has built so far and why that foundation isn’t easily shaken. At face value, wires and cables might seem like a commodity business. But in reality, KEI’s rise is a story of scale, trust, execution, and timing.

1. From projects to households: A strategic pivot to retail

KEI started off supplying cables to institutional buyers, EPC contractors, power utilities, and industrial clients. These were large orders but came with long payment cycles, low margins, and lumpy demand.

But over the last 10 years, KEI made a deliberate and steady move into the retail wires segment, targeting electricians, dealers, and individual homeowners.

This strategy has paid off handsomely.

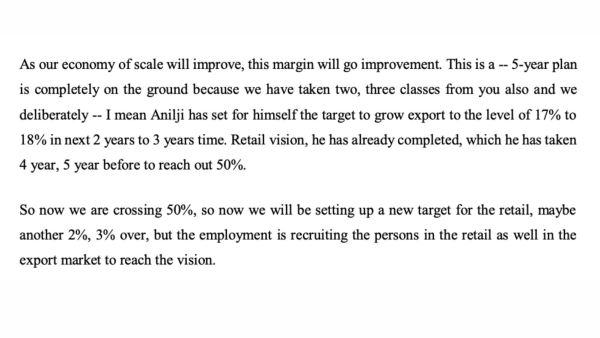

In FY15, retail sales accounted for only ~27% of KEI’s revenue. By FY24, that number had climbed to ~47%, with the management aiming for a 50%+ mix by FY26. In absolute terms, retail sales have grown at a CAGR of ~25% over the last 5 years, far outpacing institutional sales growth.

According to management, KEI’s retail revenue in FY24 was ~ Rs 3,800 crore, and the segment grew 33% YoY in Q3 FY25 alone, despite a high base.

Figure 2: KEI Ind. Management’s Opinion Retail Business.

In absolute terms, retail sales have grown at a CAGR of ~25% over the last 5 years. Source: Concall Dec 24

In absolute terms, retail sales have grown at a CAGR of ~25% over the last 5 years. Source: Concall Dec 24

This retail transformation is not just a side story, it’s central to KEI’s margin expansion and capital-light growth thesis.

2. Manufacturing scale: High utilisation, high readiness

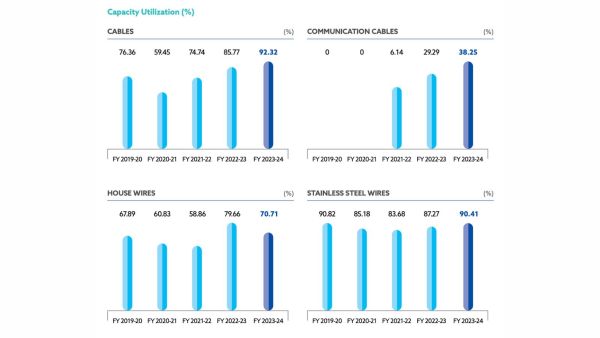

Unlike many emerging players that struggle with underutilised capacity, KEI runs a tight and efficient production engine.

It operates five manufacturing plants across India, all running at ~85% capacity utilisation as of FY24. The housing wire division specifically is running at ~70%, while stainless steel wire is at ~90%.

Figure 3: KEI Ind’s Utilization.

KEI operates five manufacturing plants across India, all running at ~85% capacity utilisation as of FY24. Source: Annual Report FY24

KEI operates five manufacturing plants across India, all running at ~85% capacity utilisation as of FY24. Source: Annual Report FY24

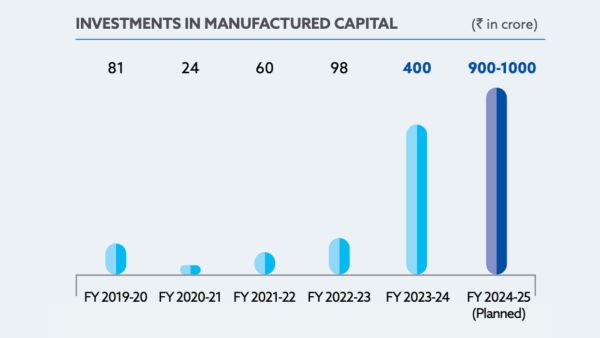

This high utilisation has allowed KEI to commit to major expansion:

The company is investing ~ Rs 1,400 crore in greenfield capex over FY24–FY26, primarily in a new facility at Sanand, Gujarat.

Once operational, the Sanand plant alone is expected to add Rs 5,000 crore to annual revenue capacity, thanks to an estimated asset turnover of 2.5x.

Total capex planned for FY26 is another Rs 500-600 crore, which will help meet export and high-voltage cable demand.

The company has also kept its balance sheet lean. As of FY24, KEI was debt-free, funding its expansion through internal accruals.

Figure 4: KEI Ind’s Capex Plans.

Total capex planned by KEI for FY26 is another Rs 500-600 crore, which will help meet export and high-voltage cable demand. Source: Annual Report FY24

Total capex planned by KEI for FY26 is another Rs 500-600 crore, which will help meet export and high-voltage cable demand. Source: Annual Report FY24

3. Distribution and trust: The real competitive advantage

In wires and cables, distribution isn’t a support function, it’s the business itself.

Electricians and local dealers act as influencers, often deciding which brand gets installed in a home, shop, or factory. KEI recognised this early and spent the last decade building what may now be its most significant moat: a deeply entrenched dealer network and brand trust.

As of FY24, KEI had:

A dealer network of over 2,000 outlets.

An increase in advertising spend over the last 10 years, positioning its brand alongside national players like Polycab and Finolex.

Consistent engagement with electricians through training programmes and incentive schemes.

The results are visible in repeat business. According to management commentary, dealer loyalty is strong and KEI’s sales velocity per distributor is among the highest in the industry.

More importantly, this dealer trust can’t be replicated quickly, even by deep-pocketed new entrants. You can spend crores on TV ads, but in a shop where 10 brands are displayed, relationships and reliability matter more than flash.

4. Technical depth: The high-voltage advantage

Beyond its retail strength, KEI also has a distinct advantage at the other end of the spectrum: Extra High Voltage (EHV) cables.

These are used in power transmission infrastructure and industrial mega-projects and require advanced technology, safety certifications, and execution history.

KEI is one of only two Indian companies (along with Universal Cables) with serious EHV manufacturing capacity and a proven track record. As of Q3 FY25:

EHV contributed Rs 598 crore to KEI’s order book.

KEI has executed EHV orders across metro projects, grid expansions, and renewable energy transmission corridors.

The segment was hit by project delays in FY24 (55% YoY decline), but capacity was reallocated to HT and LT cables, which grew 30-54% YoY, ensuring plant utilisation remained high.

What matters here is that EHV isn’t an easy market to enter. Contracts require clients to vet past project performance, safety standards, and testing capabilities.

For new entrants, it could take years just to qualify for tenders, a barrier that protects KEI’s high-value B2B business.

5. Export acceleration: Doubling the global play

India isn’t the only market electrifying rapidly. Global demand for reliable cables, especially in power infrastructure, renewables, and data centres, is booming, particularly across West Asia, Africa, and Southeast Asia.

KEI is positioning itself to capitalise on this.

Currently, exports contribute Rs 1,000 crore in annual revenue. But the company has explicitly guided to double exports by FY26, aiming for a base of ~Rs 1,500 crore within two years.

Here’s how KEI plans to do it:

The upcoming Sanand plant will have dedicated lines for export-grade cables. This is crucial because export customers often require custom specs and certifications.

KEI already has a presence in over 60 countries and is looking to deepen client relationships by shortening delivery times and offering wider SKUs.

Margins in exports are typically higher, thanks to better pricing and lower working capital requirements compared to domestic B2B.

Margins and valuation: Growth is real but so are expectations

KEI’s fundamentals have undoubtedly improved over the past decade, but in markets, past performance alone can’t drive future returns.

For investors looking at KEI today, the key questions aren’t just “how fast is it growing?” but also, “how profitable is this growth?” and “how much of that is already in the stock price?”

Let’s take a closer look at the company’s margin trajectory and valuation to understand what’s priced in and what needs to go right for more upside.

Profitability: Solid base, room to improve — but gradually

At its core, KEI operates in a material-heavy business.

Copper and aluminium form a major portion of its cost structure, typically 65-70% of total costs. That naturally puts a cap on how high margins can go. However, what KEI has managed well is stability and incremental improvement.

Over the last few years, KEI’s Ebitda margins have consistently stayed in the 10-11% range, even during periods of raw material volatility.

In FY24, Ebitda margin was around 10.3%, while net profit margin was 7.2%. This is healthy for a company in this segment, and it reflects strong operational control and a growing share of higher-margin retail and export revenue.

Management has indicated that with further growth in the retail mix and improved utilisation of new capacity, margins could gradually expand to ~12% (at par with Polycab India). This is not aggressive, it’s a natural outcome of two long-term levers: operating leverage from higher volumes and a more profitable sales mix shifting toward B2C and exports.

Still, this journey won’t be linear. In Q3 FY25, for instance, margins dipped slightly to 10.3%, down from 11.1% a year ago.

The reason? Rising copper prices and a temporary dip in EHV order execution. This highlights the fact that while KEI has built a steady margin base, it’s not immune to short-term input cost shocks.

Overall, KEI isn’t promising margin magic — it’s offering predictable profitability with scope for modest expansion. And for a capital-intensive manufacturing business, that’s often more valuable than volatile highs.

Valuation: Quality isn’t cheap anymore

As KEI’s fundamentals have strengthened, so has investor interest and the stock’s valuation has steadily climbed.

In 2018-19, KEI traded at 12-15x earnings. Today, it commands 35-40x, depending on which earnings estimate you use.

At first glance, that might seem expensive. But context matters. The entire wires and cables sector has re-rated over the past five years, as investors recognised it as a proxy for India’s infrastructure and real estate growth. Peers like Polycab and Havells also trade in the 35-50x range, though they come with their own diversification stories. KEI, by contrast, is still more of a focused cable specialist.

What’s important to understand is that KEI’s stock price today reflects belief in both its earnings growth and margin stability.

If KEI executes as planned and scales to Rs 15,000 crore revenue in the next 3-4 years, lifts margins to 12%, and maintains asset turns, then earnings can grow at 20%+ CAGR. In that case, investors holding today could see 40-50% upside over the next 3-4 years, even without further re-rating (and assuming the stock price tracks growth in earnings per share).

Note: This is not a prediction of where the stock price could head. It’s just an if-then calculation for academic purposes.

But if any of those variables falter, if margin expansion slows, if new entrants force pricing pressure, or if exports take longer to scale, the market may no longer assign a premium. In such a scenario, even strong revenue growth might not translate into share price appreciation.

Finally, the competitive landscape is changing. New entrants like the Aditya Birla Group and Adani Group are entering the wires and cables space. Both have strong financial resources, access to raw materials, and existing networks through other businesses. While they are starting from scratch, their entry could lead to more aggressive pricing and increased pressure on existing players.

KEI’s strength lies in its distribution network, brand trust, and ability to deliver on time. But it will need to work harder to protect its market share, especially in the lower-margin retail wire category where new players are likely to begin.

So what does this mean? KEI isn’t overvalued, but it’s no longer a deep value play either. It sits in that middle zone where future returns will be driven more by earnings growth than by a rising multiple. For long-term investors, that’s not a red flag, it’s just a signal to focus more on fundamentals than on momentum.

Note: We have relied on data from the annual report and industry reports for this article. For forecasting, we have used our assumptions.

Parth Parikh has over a decade of experience in finance and research, and he currently heads the growth and content vertical at Finsire. He has a keen interest in Indian and global stocks and holds an FRM Charter along with an MBA in Finance from Narsee Monjee Institute of Management Studies. Previously, he has held research positions at various companies.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

Apr 11: Latest News

- 01

- 02

- 03

- 04

- 05