Tata Asset Management has launched Tata BSE Quality Index Fund, a passive fund tracking the BSE Quality Index. With the current volatility, investors may look for safety in large-caps, underperforming ‘quality’ names or even gold. Quality is a bucket that may witness a flight to safety. But what qualifies as quality and which investors it is suitable for is worth examining. Here, we look at the index construction and its performance compared to the broader index to assess what ‘quality’ brings to the table.

Quality

As quality is an undefined factor, BSE Quality index has used a factor-based construction to define quality. The factors are RoE, debt and working capital discipline. This is to simplify the factors.

The first factor is RoE or return on equity, one of the most sought-after metric in investing. This represents the sturdiness of the asset base to generate high returns, in excess of debt, to the equity holder. This is accomplished by high margins which flow through to the balance sheet. This may also represent high growth and highly investible sectors as well; a small asset base generating high returns in the growth phase.

Low debt is the second factor; the third factor, working capital discipline, is assessed by accrual ratio. Accrual ratio is defined as change in net operating assets as a percentage of total assets. Lower the better. But this measures the growth in non-cash or accruals which are inventories, receivables and other assets and liabilities. If the accrual ratio is high, this implies that growth is not backed by cash but is accrued in the balance sheet which is deemed riskier.

The three factors (weighed equally) show the emphasis is on better management as a measure of quality quantified by better asset utilisation (RoE), low debt and operating discipline.

Investors must glean that any implied safety in the index construction is a by-product of quality and not the first objective of the index. Value funds with a low PE, dividend funds with dividend yield acting as a floor, are the ones aiming for safety. BSE Quality index constitutes risk assets with an element of high growth, high competition and just as much volatility as the broader index. Consider high RoE factor. Paints and wires are high RoE sectors. This was the reason for increased capital allocation in these sectors recently witnessed. Despite ticking off the three boxes, high RoE, low debt and strong working capital, these sectors have recently come under stress. Even the accrual ratio cannot guarantee safety. The FMCG companies prided on strong working capital (even negative in some cases), but structural shifts in the form of quick commerce, low demand and high competition have impacted the sector.

Index performance and constituents

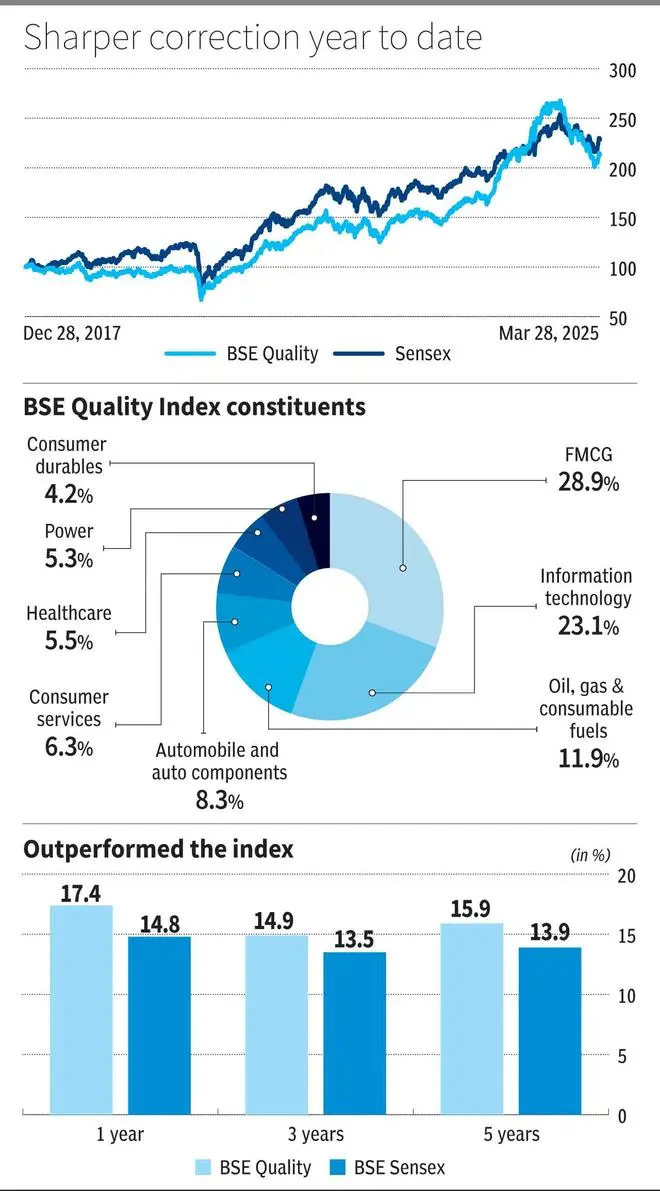

The long-term performance of BSE Quality index does hold up well against the broader BSE Sensex. The index outperformed BSE in 1-3-5 year rolling returns as shown in the table. On the question of safety, the index has mixed verdict. In the Covid period (January 1, 2020 to March 31, 2020), the index did outperform BSE Sensex (-21 per cent Vs -28 per cent for BSE). But YTD the index declined by 7 per cent compared to 1 per cent decline in BSE Sensex.

Given the factors of RoE, debt and working capital, more than half of the index is composed of FMCG (29 per cent) and IT (23 per cent) as shown in the table. The index is well diversified too with the top five companies accounting for 32 per cent by weight.

Overall, investors seeking high RoE, low debt and strong working capital companies can consider investing in the index. But with an expectation of growth and safety in the form of better management. The heavy concentration of IT and FMCG stocks also has to be considered as the two have faced headwinds and outlook is still mixed.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.