Volume 28 | Issue 1

Click here to read the complete illustrated article or continue below to read the text article.

The U.S. has shifted from producing the lion’s share of the world’s goods to now relying heavily on imports. In the mid to late 1940s America produced half of the world’s manufacturing output, much higher than the 28% that China produces today.

Offshoring became prevalent in the late 1970’s when large U.S. corporations began moving manufacturing to low-cost countries. Not only did OEMs offshore much of their own manufacturing but suppliers were also encouraged to migrate offshore. This “asset-light” business model minimized physical assets like manufacturing facilities, relying instead on outsourced offshoring and focusing on R&D, marketing, and finance.

Assets were reduced and margins increased, driving ROA. Offshoring grew to a value proposition that could sidestep strict U.S. workplace and environmental regulations while taking advantage of low offshore wages and foreign government subsidies.

The bottom fell out in 2001 when China joined the World Trade Organization (WTO), removing barriers to its exports globally. A surge of inexpensive Chinese goods flooded the U.S., transforming manufacturing towns and the U.S. economy itself. The U.S. lost millions of manufacturing jobs, a phenomenon economists call “China Shock”.

America’s competitive edge dulled as institutional knowledge, intellectual property, technology, mission critical components and process engineering were transferred to foreign competitors. U.S. manufacturing communities experienced higher unemployment, lower wages, higher disability payments, higher rates of child poverty, and elevated mortality. The ramifications were reduced competitiveness, more vulnerability to geopolitical risk and a depleted U.S. workforce.

Growing trade deficits from globalization eliminated six million U.S. manufacturing jobs over 6 decades and approximately 70,000 factories.

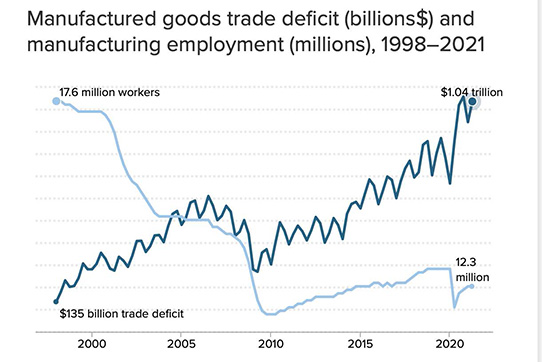

Our large trade deficit, a measure of offshoring or lack of self-sufficiency, is primarily due to the U.S. not being price competitive on a broad range of products. The strong correlation between the trade deficit and declining manufacturing employment is clear in Figure 1.

For the US to recover millions of lost jobs, China’s growth has to slow. China’s economy enjoyed an average annual growth of 9.5% from 1978 until 2019 and then began to feel the effects of a structural slowdown. China’s economic growth rate slumped to a three decade low in 2023 (5.2%) as a result of the 4D’s: demographics, debt, drought and decoupling.

Birthrates in China are falling, and its population is aging. Risky investment activity has led to inflated real estate, land bubbles and unsustainable debt. China’s unequal water distribution is contributing to a water shortage crisis. In 2024, China’s net Foreign Direct Investment (FDI) inflows turned negative to -4.6B as foreign firms repatriated earnings back home instead of adding new China investments.

The US has to reshore to avoid further hollowing out of manufacturing before China peaks.

To facilitate an economic rebound from the 4D’s, Beijing doubled-down on investments in industrial overcapacity, flooding global markets with low-priced hi-tech exports, exacerbating global trade tensions. China’s excessive investments are a $450 billion tsunami that threatens the market over the next three years.

This overcapacity push is ushering in a sequel to the first “China shock.” The export surge will depress global prices and, if left undeterred, will inhibit development of U.S. hi-tech industries, enabling China to capture important sectors. To thwart China’s overcapacity and its impact on trade, section 301 tariffs have been extended, increased and broadened on a range of hi-tech Chinese goods.

Since the beginning of the trade war, China has targeted U.S. companies with legislation like the “unreliable entry list” and the “anti-foreign sanctions law.” Penalties imposed on companies or individuals include restriction of trade, investment and visas, and even sweeping powers to seize assets and block business transactions of actors that China perceives as harming its interests.

U.S. manufacturers should consider reshoring to mitigate the risks of retaliation. Localizing production and sourcing will not only reduce geopolitical risk but also make supply chains more resilient and sustainable, encourage investment in infrastructure and workforce development, strengthen the U.S. economy and generate well-paying jobs in manufacturing and other industries through the multiplier effect.

Reshoring hi-tech manufacturing ecosystems reduces offshore dependence and secures high-value supply chains that are vital to U.S. economic and national security. Studies show that geopolitical turbulence and the need for resilient/sustainable supply chains, is disrupting offshoring.

Localization plans jumped to 81% (2024) from 63% (2022) with 64% reporting ongoing investment and execution in reshoring and nearshoring. Companies shifting operations out of China rose to 69% (2024) from 55% (2022).

Today, reshoring and foreign direct investment (FDI) trends are demonstrating strength and longevity, driven by risks associated with global politics, and climate change, and by supportive U.S. industrial policies. Investment in U.S. manufacturing has been rising with a key focus on shortening supply chains. The cumulative number of jobs announced coming back since the manufacturing low in 2010 is now approximately two million.

U.S. policy has created favorable conditions for reshoring and FDI via the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS and Science Act. U.S. reshoring is driving a manufacturing construction boom with investment in manufacturing facilities reaching a new record of US$238 billion in 2024, contributing the most to real year-over-year GDP growth since 1958.

But as government subsidies run out, new reshoring and FDI announcements are slowing. Future progress will depend on new policies that make U.S. manufacturing broadly cost competitive, rather than subsidizing specific industries.

Acceleration of the trend depends on the government leveling the playing field. We should quantify the competitiveness gap with a unified, quantified, broadly supported proposal for the nation. The Reshoring Initiative’s Competitiveness Toolkit is a good start on the reshoring and job impact of most of these actions.

Continuation of the trend depends on companies reevaluating their offshoring. Companies can use the Reshoring Initiative’s free online TCO Estimator and our new Geopolitical Risk measure to compare alternative sources.

Workforce development is a top priority. It is essential that the United States have a sufficient number of workers with the skill-level necessary to use the most modern equipment and technologies to achieve the required cost competitiveness and quality. This factor is the sine qua non of reshoring and rebuilding.

Automation is essential to bridging the cost gap. Reshoring and increased domestic demand are critical to enabling automation. When factories are busy and profitable, they can justify the investment.

President Trump has promised more tariffs and lower taxes. Companies are closely monitoring the situation. But the unpredictability and “tariff whiplash” are creating uncertainty for U.S, manufacturers’ supply chains and investment plans.

The potential tariff threats do however seem to be moving the needle on reshoring and FDI consideration. To mitigate potential tariffs, some U.S. companies like 3M and Polaris are already considering reshoring and foreign companies like Samsung, LG, Hyundai Steel, Volkswagen Group’s premium brands Audi and Porsche, and South Korean biopharma contract manufacturer Celltrion are considering FDI.

If we are going to use tariffs, I believe that they should apply to all products from all countries forever. The best way to do a tariff is through a value-added tax (VAT) because, unlike a direct tariff, it would not lead to retaliation since US peers all already have a VAT so they have no grounds to retaliate. And yet it would tax, say, 15% of everything coming in, and then subsidize our exports at the same percentage.

Our main mission is to get companies to do the math correctly using our free online Total Cost of Ownership Estimator® (TCO). By using TCO, companies can better evaluate sourcing, identify alternatives and even make a case when selling against offshore competitors. For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org.

Have you reshored a metal component or product? Apply for the National Metalworking Reshoring Award.

About the Author:

Harry Moser is Founder/President, Reshoring Initiative®. Harry founded the Reshoring Initiative® to bring five million manufacturing jobs back to the U.S. after serving as president for high end machine tool supplier GF AgieCharmilles. Harry was inducted into the Industry Week and Association for Manufacturing Excellence’s (AME) Halls of Fame and was named FAB Shop Magazine’s Manufacturing Person of the year. Harry participated actively in President Obama’s 1/11/12 Insourcing Forum at the White House and won The Economist debate on outsourcing and offshoring. He was recognized by Sue Helper, then Commerce Department Chief Economist, as the driving force in founding the reshoring trend and named to the Commerce Department Investment Advisory Council in August 2019. Harry testified at the June 9, 2022 Senate commission Hearing on U.S. supply chains and China.

Harry is regularly quoted in the national business media and seen on national TV programs. He received a BS in Mechanical Engineering and an MS in Engineering at MIT in 1967 and an MBA from U. of Chicago in 1981.

Harry Moser Reshoring Initiative®

web: http://www.reshorenow.org

blog: http://www.reshorenow.org/blog/

https://www.linkedin.com/in/harry-moser-58a8024/

Sarasota, FL — The Reshoring Initiative®, in collaboration with Regions Recruiting®, today announced the launch of an industry-wide survey examining what is factoring into manufacturers’ decisions on whether to reshore factories and supply chains. This research comes at a critical time as the U.S. rebuilds its hollowed-out manufacturing base. The nationwide survey, released on January 28, 2025, will remain open to respondents through April 15, 2025. The survey will gather experience and insights from manufacturing operations, supply chain/procurement decision-makers, contract manufacturers and distributors. We are calling on OEMs, contract manufacturers and distributors to take the Survey now.

Tune in to hear from Chris Brown, Vice President of Sales at CADDi, a leading manufacturing solutions provider. We delve into Chris’ role of expanding the reach of CADDi Drawer which uses advanced AI to centralize and analyze essential production data to help manufacturers improve efficiency and quality.

Notifications