Asian markets sink as autos suffer more tariff-fueled losses

HONG KONG, China — Auto companies once again took the brunt of the selling on another tough day for markets on Friday after President Donald Trump announced steep tariffs on vehicle imports to go with a wave of other US levies penciled in for next week.

The mood on trading floors has soured in recent weeks as the White House presses ahead with its hardball policy approach that has hit friend and foe alike and fueled recession fears.

The president’s pledge to impose 25 percent levies on all autos coming into the United States overshadowed earlier indications that planned reciprocal measures due on Trump’s “Liberation Day” on April 2.

READ: Trump announces 25% tariffs on foreign-built vehicles

Governments around the world have hit out at the announcement, with Canadian Prime Minister Mark Carney saying the “old relationship” of deep economic, security and military ties with Washington “is over”.

But warnings of retaliation have stoked worries of a long-running global trade war and a reignition of inflation that could force central banks to rethink plans to cut interest rates.

Uncertainty over Trump’s plans and long-term intentions has led to uncertainty among investors, sparking a rush out of risk assets into safe havens such as gold, which hit a new record high of $3,085.96 Friday.

Analysts said that while there is hope negotiations with Washington could see the duties tempered, investors were likely choosing to play a wait-and-see game.

Mixed bag

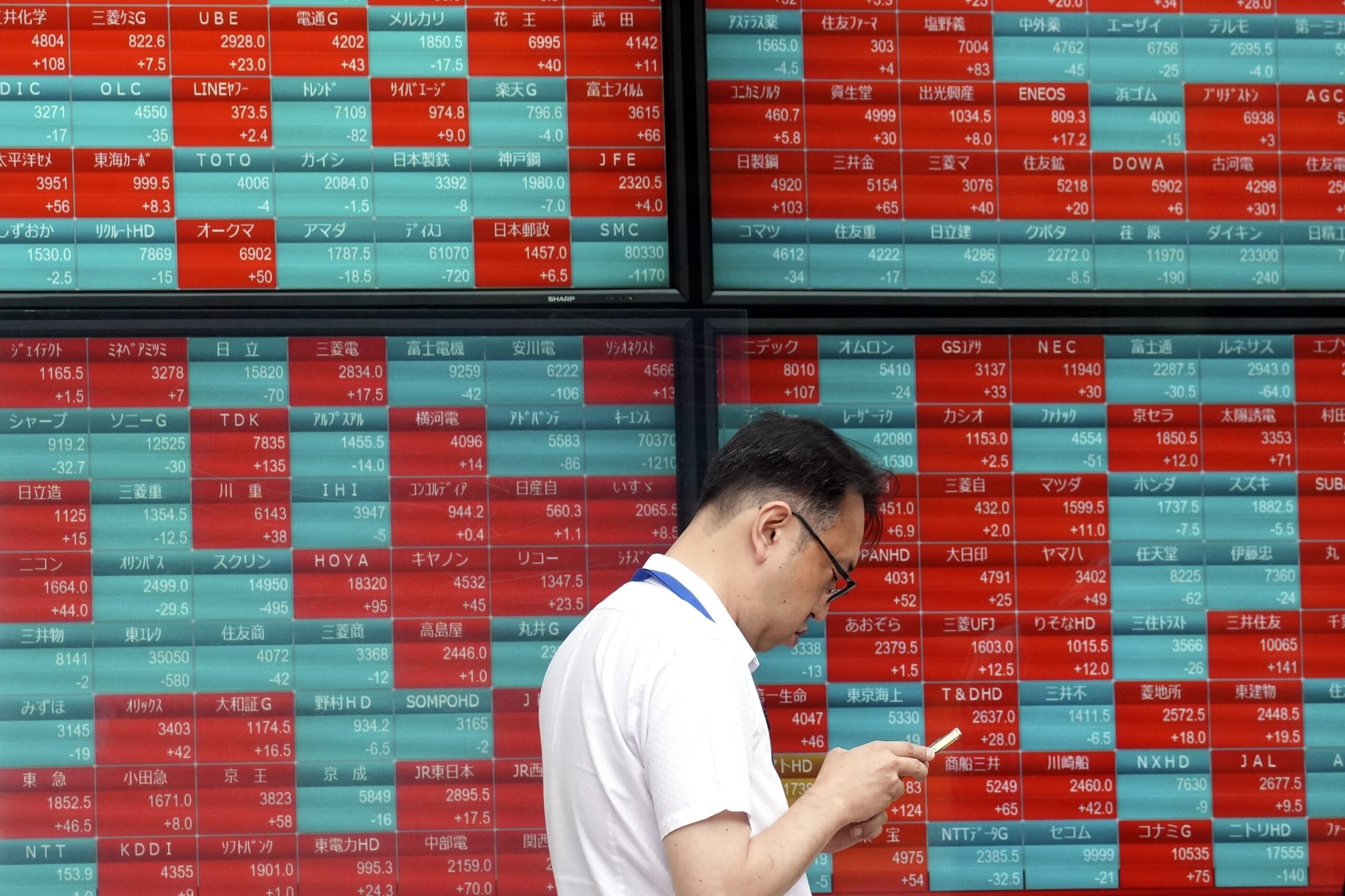

Equity markets in Asia were mixed on Friday after another down day on Wall Street, with auto firms again taking the brunt.

Tokyo sank 1.8 percent as Toyota — the world’s biggest carmaker — Honda, Nissan and Mazda tumbled between 1.3 and 3.9 percent.

Also in the red was Nippon Steel after it said it would invest as much as $7 billion to upgrade US Steel if its huge takeover goes ahead. It had initially flagged a $2.7 billion investment.

Seoul was off 1.9 percent as Hyundai gave up 2.6 percent.

Tariff worries also saw Hong Kong, Shanghai, Singapore, Taipei, Wellington and Mumbai fall.

Bangkok was in the red when trading was suspended as the Thai capital was shaken by a powerful earthquake in neighbouring Myanmar.

Sydney and Manila edged up.

READ: Philippine stocks buoyed by bargain hunt

London fell at the open even as data showed the UK economy expanded more than initially indicated last year.

Paris and Frankfurt also opened lower.

All eyes on China

Investors were keeping tabs on Beijing, where Chinese leader Xi Jinping met leading business leaders pledging the country’s door would “open wider and wider”.

“China is firmly committed to advancing reform and opening up,” Xi told the executives, including hedge fund boss Ray Dalio and Samsung Electronics chief Lee Jae-yong.

He also warned the world trading system was facing “severe challenges”.

US personal consumption expenditures data — the Federal Reserve’s preferred gauge of inflation — is due to be released later in the day, with traders hoping for an idea about the impact of Trump’s policies.

The figures come after data this week showed consumer confidence was at its lowest level since 2021 — during the Covid-19 pandemic — owing to growing concerns over higher prices.

News that the US economy expanded at a slightly faster pace than estimated in the final three months last year did little to stir excitement.

On currency markets, the yen strengthened against the dollar after a report showing inflation in Tokyo — a barometer of Japan as a whole — rose more than expected in March, boosting bets on another central bank rate hike.

Key figures around 0815 GMT

Tokyo – Nikkei 225: DOWN 1.8 percent at 37,120.33 (close)

Hong Kong – Hang Seng Index: DOWN 0.7 percent at 23,426.60 (close)

Shanghai – Composite: DOWN 0.7 percent at 3,351.31 (close)

London – FTSE 100: DOWN 0.2 percent at 8,650.44

Euro/dollar: DOWN at $1.0789 from $1.0796 on Thursday

Pound/dollar: UP at $1.2952 from $1.2947

Dollar/yen: DOWN at 150.46 yen from 151.04 yen

Euro/pound: DOWN at 83.34 pence from 83.38 pence

West Texas Intermediate: DOWN 0.5 percent at $69.59 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $73.70 per barrel

New York – Dow: DOWN 0.4 percent at 42,299.70 (close)