The dividend forecast is important for any investor. It tells us how much we can expect to receive in the form of typically biannual payments if we purchase shares in the company.

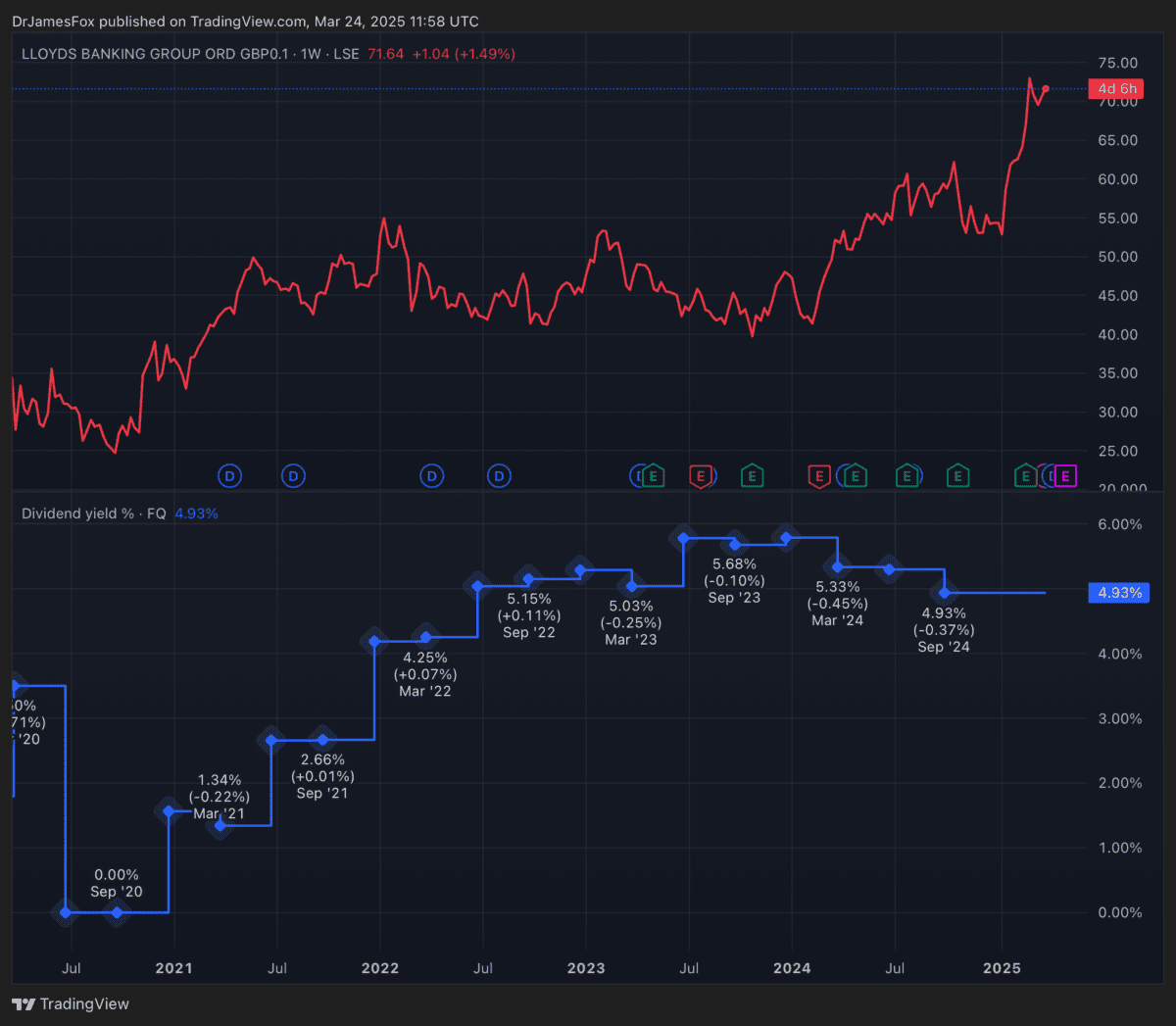

So, today I’m looking at Lloyds. The stock has surged over the past 12 months, and as a result, the dividend yield has fallen somewhat. Looking at the forward yield — the dividend yield an investor could expect to receive based on forecasts over the next 12 months — is 4.9%.

That’s quite strong compared to the FTSE 100 average, but it’s actually lower than the 6% yield I received in my first year when I entered the stock around 24 months ago.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

Where’s it going next?

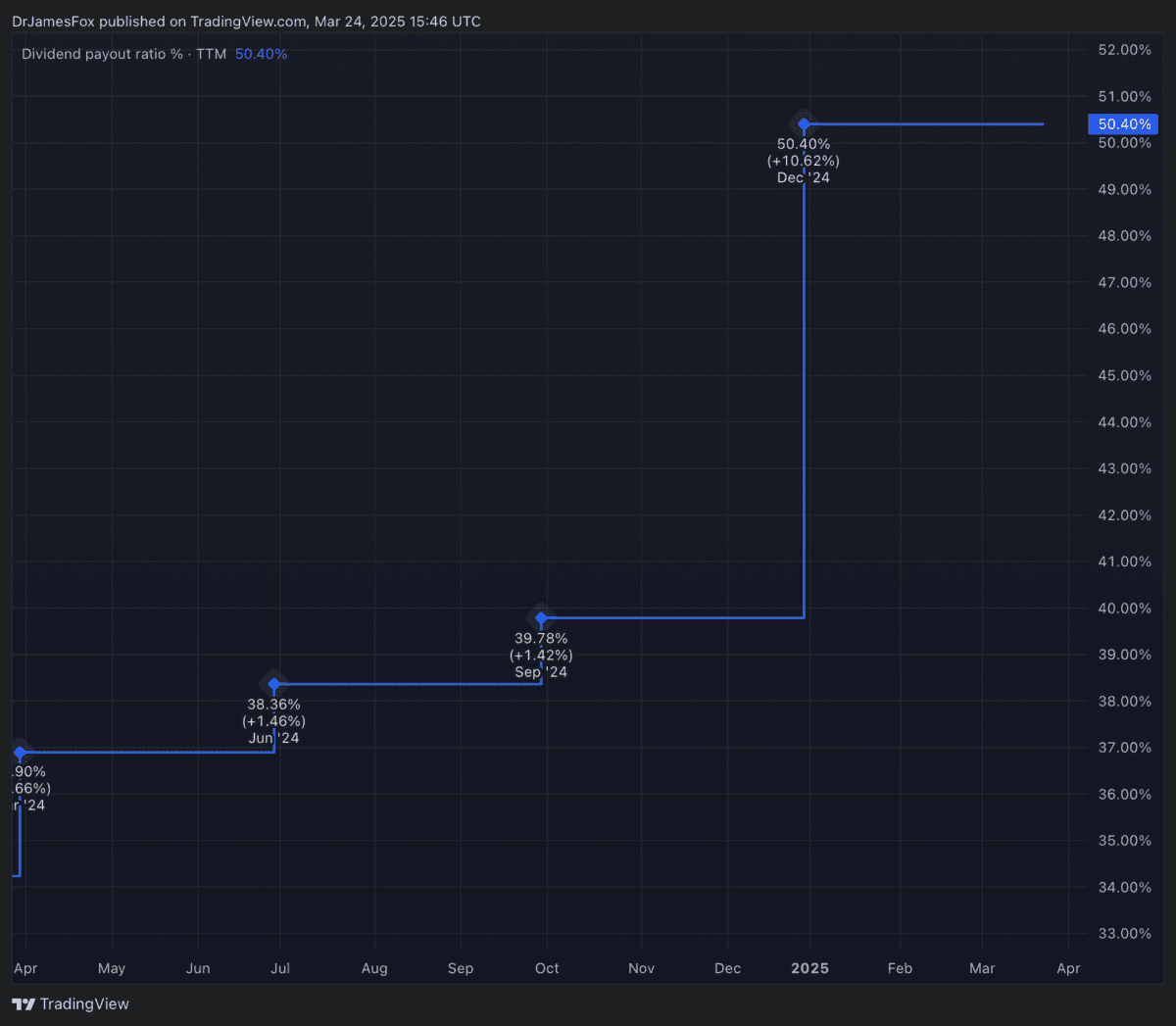

Interestingly, the data suggests that Lloyds is much more generous than some of its peers. It’s giving away more than half of earnings to shareholders. The currently coverage ratio of 2025 — this is based of earnings projections and dividend forecasts — is 1.95. It’s strong, but could be a little stronger.

Thankfully, both earnings and dividends are expected to improve throughout the medium term. In fact, earnings are expected to jump from around 6.6p per share in 2025 to 8.8p in 2026, and then to 10.6p in 2027. This isn’t purely organic, as 2025 will likely see large impairments related to motor finance mis-selling.

Nonetheless, this earnings growth is good for dividends and their sustainability. The dividend payments are expected to increase from 3.4p in 2025 to 4p in 2026, and then to 4.6p in 2027. This equates to a 5.8% yield for 2026 and a 6.6% yield for 2027 if an investor bought the stock today.

Growing earnings will also see the dividend coverage ratio rise to around 2.2 by 2027. That’s a good sign.

Things to consider

While the bank’s dividend forecast looks promising, potential risks loom. The impact of motor finance mis-selling could be more significant than anticipated, with Lloyds already setting aside £1.2bn for compensation. This issue may continue to affect profitability.

Additionally, the UK economy faces growth challenges under the Labour government, with GDP growth forecasts for 2025 ranging from 1.2% to 1.5% — lower than it has been. These economic issues could impact Lloyds’ performance, damaging demand for loans and increasing bad debt. Investors should monitor these developments closely when evaluating Lloyds as a dividend stock.

A lesson for later

Not every stock goes up in value and not every dividend rises. However, I, and my fellow Fool analysts, especially John Choong, had a lot of conviction when Lloyds shares were trading around 40p. And with my weighted cost around 40p, my forward dividend yield is around 8% for this year. That jumps to 10% in 2026 and 12% in 2027. While this isn’t a Warren Buffett and Coca Cola story — his initial investment now yields over 50% — it’s an important lesson in investing. Personally, having already built a sizeable position in Lloyds, I’m not buying more right now.