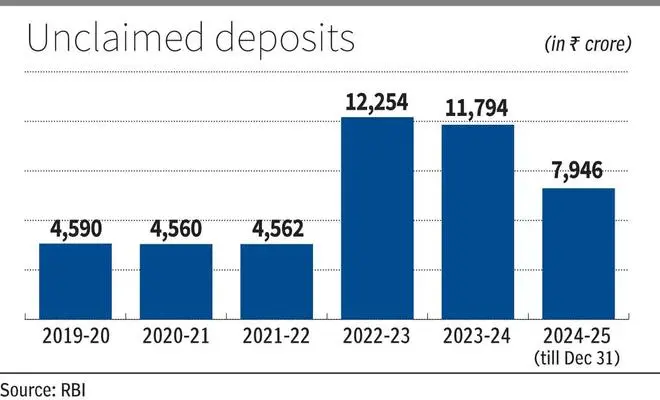

Over ₹45,000 crore worth of “unclaimed deposit” has been transferred by public sector banks to the Depositor Education and Awareness Fund between 2019-20 and 2024-25 (till December 31, 2024), the Finance Ministry informed the Lok Sabha on Monday.

Balances in savings and current accounts that remain inoperative for 10 years, or term deposits not claimed within 10 years from the date of maturity are classified as unclaimed deposits. Once declared ‘Unclaimed’, these are transferred by banks to the Depositor Education and Awareness (DEA) Fund maintained by RBI. This fund is managed under the ‘Depositor Education and Awareness Fund Scheme, 2014.’

However, funds transferred in the DEA fund can be reclaimed. “The depositors or their legal heirs may claim unclaimed deposits from their respective banks, and upon verification, banks process the repayment, including applicable interest in the case of interest-bearing accounts. Banks then lodge a claim with RBI for reimbursement from the DEA Fund,” Pankaj Chaudhary, Minister of State in the Finance Ministry said in a written reply.

Last year, RBI launched a portal, UDGAM (Unclaimed Deposits-Gateway to Access information), to facilitate registered users to search unclaimed deposits/accounts across multiple banks at one place in a centralised manner. Thirty banks are part of UDGAM portal, and they cover around 90 per cent of unclaimed deposits (in value terms) in DEA Fund. The effort is to bring other banks on the portal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.