Investors with a lot of money to spend have taken a bearish stance on Citigroup C.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with C, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 23 uncommon options trades for Citigroup.

This isn't normal.

The overall sentiment of these big-money traders is split between 43% bullish and 47%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $564,169, and 14 are calls, for a total amount of $4,129,073.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $67.5 to $90.0 for Citigroup over the last 3 months.

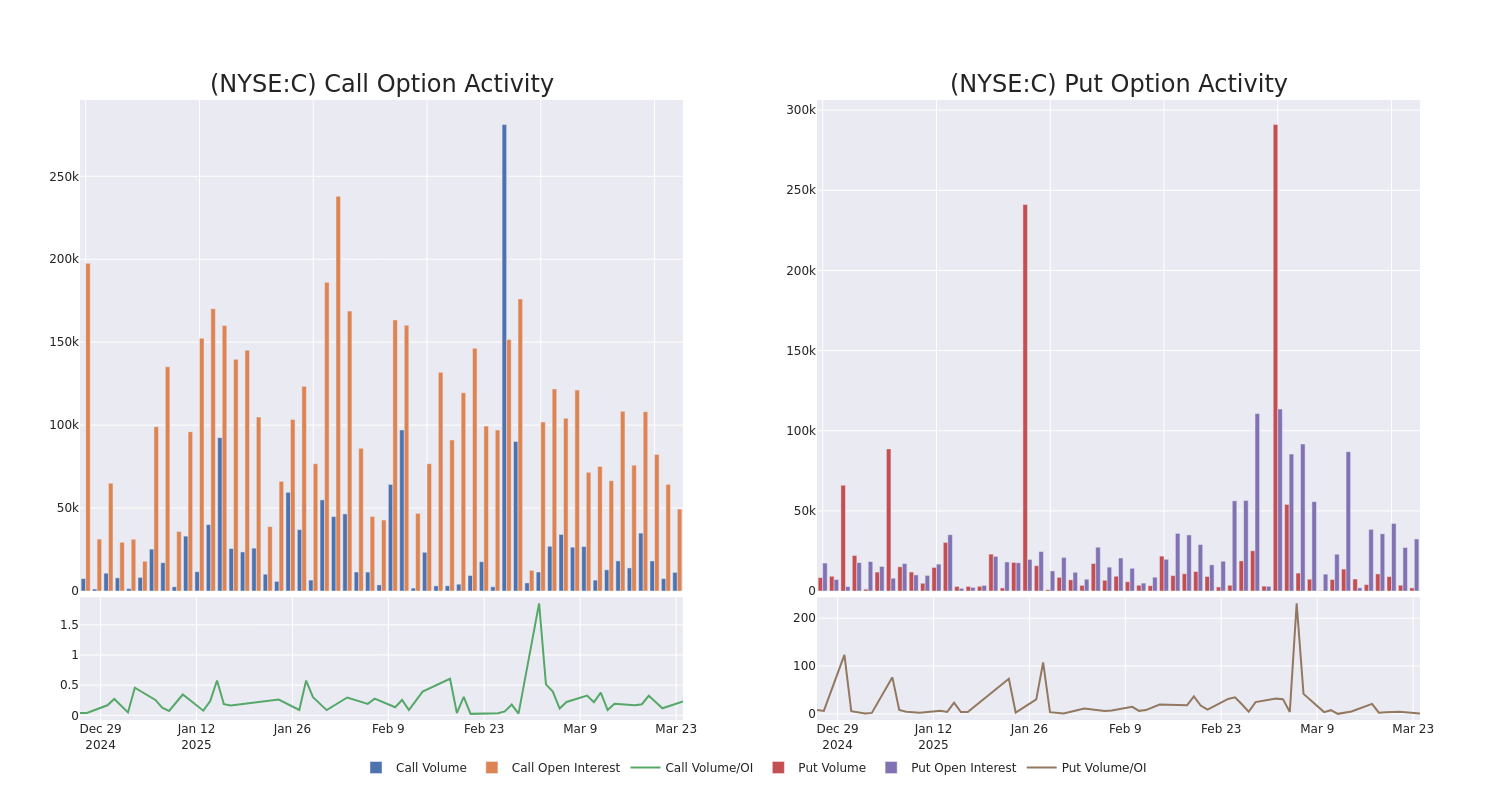

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Citigroup's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Citigroup's whale activity within a strike price range from $67.5 to $90.0 in the last 30 days.

Citigroup Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | CALL | SWEEP | BEARISH | 01/15/27 | $9.35 | $7.9 | $8.55 | $80.00 | $1.6M | 2.6K | 2.9K |

| C | CALL | TRADE | BEARISH | 04/25/25 | $1.71 | $1.54 | $1.6 | $76.00 | $960.0K | 63 | 6.0K |

| C | CALL | SWEEP | NEUTRAL | 01/15/27 | $8.7 | $7.85 | $8.68 | $80.00 | $477.4K | 2.6K | 0 |

| C | CALL | SWEEP | BULLISH | 01/15/27 | $9.5 | $7.85 | $8.68 | $80.00 | $390.6K | 2.6K | 1.0K |

| C | CALL | SWEEP | BULLISH | 03/20/26 | $7.95 | $7.85 | $7.95 | $75.00 | $174.1K | 2.3K | 300 |

About Citigroup

Citigroup Inc is a global financial services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

In light of the recent options history for Citigroup, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Citigroup's Current Market Status

- Trading volume stands at 4,384,207, with C's price up by 2.57%, positioned at $73.83.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 22 days.

Professional Analyst Ratings for Citigroup

In the last month, 3 experts released ratings on this stock with an average target price of $93.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Goldman Sachs persists with their Buy rating on Citigroup, maintaining a target price of $80. * An analyst from B of A Securities has decided to maintain their Buy rating on Citigroup, which currently sits at a price target of $90. * An analyst from Morgan Stanley persists with their Overweight rating on Citigroup, maintaining a target price of $109.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Citigroup with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.