James Hardie tumbles on $14b US deal, ASX ekes out a marginal gain ahead the of budget — as it happened

James Hardie shares tumbled after it announced it is buying US outdoor products manufacturer AZEK for $14 billion.

The ASX eked out a marginal rise, supported by solid gains in financial stocks and a late fightback among the miners.

See how the day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.1% to 7,937 points (live values below)

- Australian dollar: +0.1% to 62.77US cents

- Asia: Nikkei flat, Hang Seng -0.1%, Shanghai composite -0.3%

- Wall Street (Friday): Dow +0.1%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX -0.5%, FTSE -0.6%, Eurostoxx -0.5%

- Spot gold: flat at $US3,019/ounce

- Brent crude: -0.3% to $US71.89/barrel

- Iron ore (Friday): -0.6% to $US99.90 a tonne

- Bitcoin: +2.1% to $US86,904

Prices current around 4:20 pm AEDT

Live updates on the major ASX indices:

Goodbye

That's it for another day on the markets blog. A fair bit happened for a market that pretty well went nowhere.

The ASX 200 edged up less than 0.1% — still not a bad result given where it started the day.

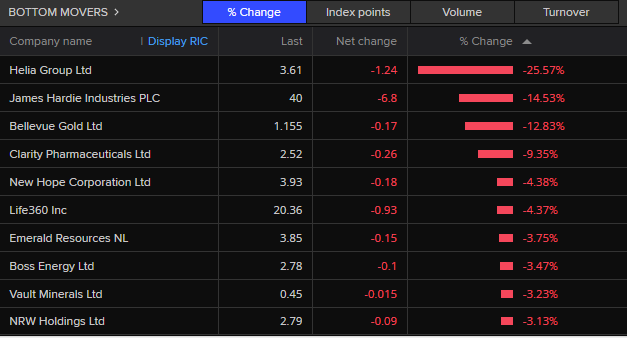

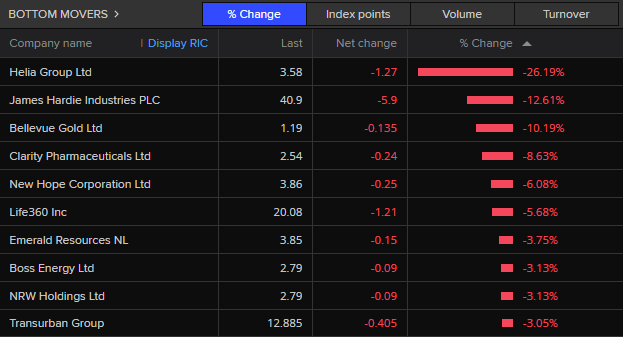

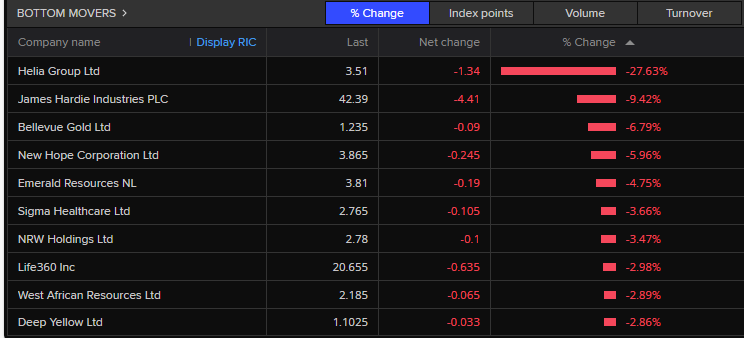

It was a bruising day for building materials supplier James Hardie after its proud announcement of a $8.8 billion merger/takeover of the NYSE-listed AZEK was not met with applause but the sound of investors bolting for the exit. It dropped more than 14%.

The lender mortgage insurance provider Helia (formerly known as Genworth) had an even worse day, losing a quarter of its value after confirming its major client CBA, which accounts for 44% of its business, was in advanced negotiations with an exclusive deal with another mortgage insurer not named Helia.

Across the region, most markets lost ground or were fairly flat.

Looking ahead, Wall Street is set for a solid start to the week with S&P 500 futures up 0.7%, while tech stocks futures and the small cap futures are up 0.8%.

We'll be back early tomorrow morning for the long haul through to the budget. I'm sad not to be pulling that shift.

Anyway, until next time.

LoadingOn The Business with Kirstin Aiken tonight

Tomorrow's federal budget is the focus of The Business tonight.

Daniel Ziffer previews Canberra's "night of nights", while Kirsten Aiken talks to Barrenjoey's veteran budget watcher Jo Masters about what to expect and what to look out for.

Kirstin also catches up with nabtrade's Gemma Dale about a fairly lacklustre start to the week on the ASX and the day's two big casualties, Helia and James Hardie.

That's tonight on The Business 8:45pm AEDT on ABC News, after the late news on ABC-TV or catch up anytime on ABC iView.

ASX makes a marginal gain as James Hardie and Helia crash

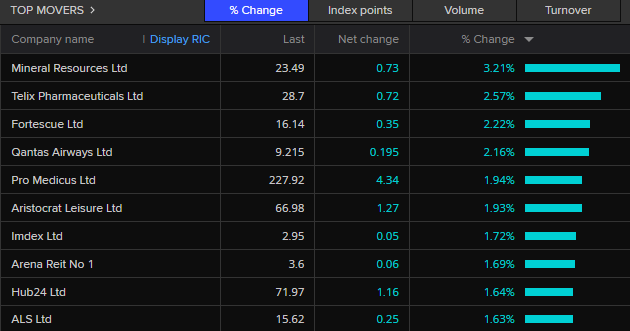

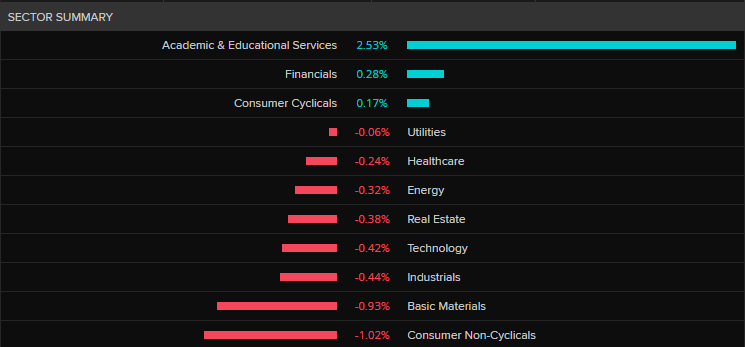

The ASX battled back from an early stumble to end the day with a marginal gain, pretty well mimicking Wall Street's lacklustre lead.

The ASX 200 closed 0.1% higher, up just 6 points to 7,937 points, while the broader All Ordinaries index was flat, down less than 1 point to 8,158 points.

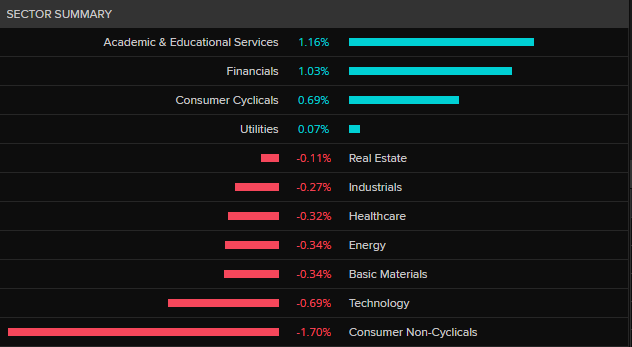

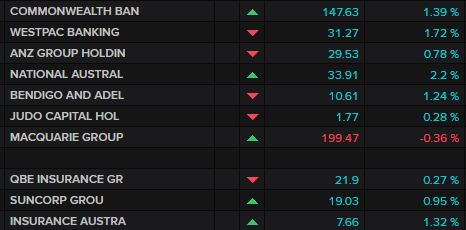

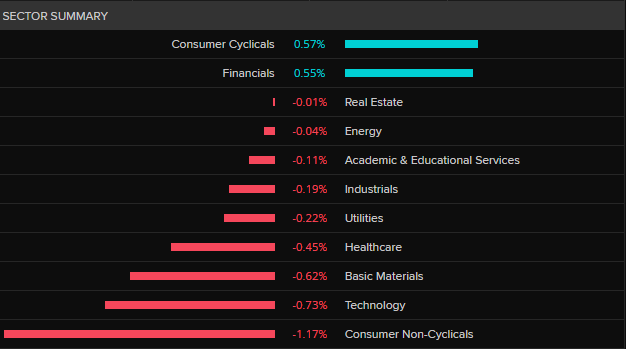

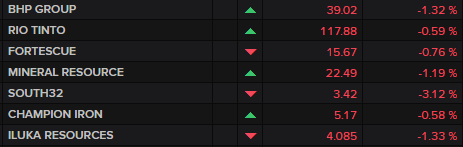

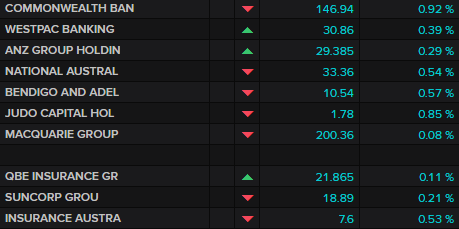

Financials did most of the heavy lifting, while on the other end of the ASX barbell, the miners were something of a dead weight.

The miners were initially dragged down by falling Chinese economic sentiment and lower bulk-material prices but fought back later in the session.

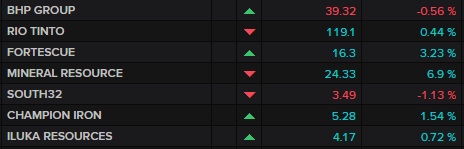

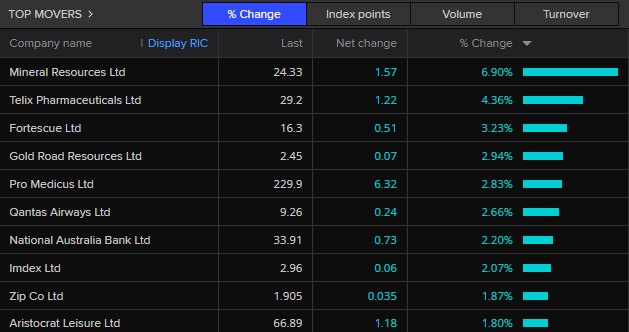

BHP fell 0.6%, while Fortescue and Mineral Resources made strong gains

Fortescue (+3.2%) benefited from a broker upgrade from UBS (South 32 was hit with a downgrade from the same analysts), while Mineral Resources (+6.9%) benefited from reopening its Onslow Iron Project haulage operations after another road train tumbled off the unsealed road last week.

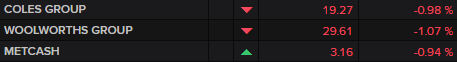

Supermarkets gave up a bit of last week's gains as investors realised that while they may have dodged a bullet with the ACCC report, it was business as usual in the grocery game.

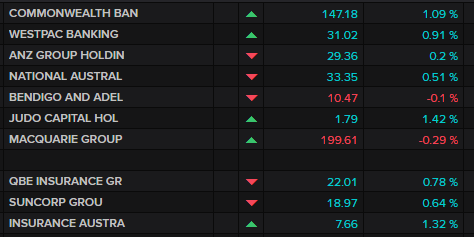

Banks and insurers were solid in the face of early selling pressures and were the biggest positive on the overall market, with only Macquarie (-0.4%) significantly down.

Investors didn't warm to James Hardie's (-14.3%) announcement of a $14 billion merger with NYSE-listed AZEK.

NRW Holdings (-3.1%) and New Hope (-4.4%) both went ex-dividend this morning.

But the biggest casualty was mortgage insurer Helia (-25.6%) on news it was likely to lose its contract with CBA (and 44% of its business) as the bank noted it was shopping around for alternative mortgage insurers.

Mineral Resources was biggest winner, while Telix Pharmaceuticals gained 4.4% after the US FDA approved its next generation prostate cancer diagnosis kit for use.

Qantas (+2.7%) has also regained a bit of altitude in the midst of global sell-off in aviation stocks.

Helia's heavy reliance on CBA a concern: S&P Global

The vertiginous decline of mortgage insurance business can be explained by its heavy reliance on CBA for its business, a business it concedes it may well lose.

At 3pm AEDT, Helia shares were down more than 25% to $3.60 per share.

On S&P Global's numbers, CBA accounted for 44% of Helia's gross written premiums in 2024.

Helia told the ASX via a statement this morning that it had been informed that CBA had entered into exclusive negotiations with an alternative provider of lender mortgage insurance (LMI) services.

If the negotiations result in CBA changing its LMI supplier, Helia said its contract would not be renewed beyond the current expiry date of December 31, 2025.

Helia CEO Pauline Blight-Johnston said she was "disappointed" by the development after a 50-year partnership with CBA.

"We will continue to work closely with CBA to ensure that we are supporting both CBA and its borrowers through to December 2025 and beyond," Ms Blight-Johnston said.

The ratings agency S&P Global said the termination of the contract would hinder future business flows for the supplier of lenders' mortgage insurance.

"Given that earnings are recognized over 15 years, the effect on operating performance would be gradual," S&P noted.

CBA's decision to look elsewhere for an LMI provider follows a decision by NAB in 2020 to switch from Helia (then known as Genworth Mortgage Insurance) to QBE.

Coincidently, Ms Blight-Johnston filed a director's change of interest notice with the ASX showing she had sold about 150,000 shares in three tranches last week valued at $840,000, having exercised her rights to transfer her entitlement to 25,000 shares into fully paid shares earlier in the month.

However, boardroom colleague and independent Helia director JoAnne Stephenson is well and truly out of the money, with her change of interest notice this morning showing she picked up 10,000 shares valued at $49,000 on Friday.

Supermarket stocks give back some gains

Shares in both Woolworths and Coles are underperforming the broader market today.

Coles has dropped 1.4 per cent, while Woolies shares are down 1.1 per cent.

IGA-supplier Metcash is also on the slide, down 1.3 per cent.

However, it follows a big bounce for all three companies on Friday — in the final session of last week, Coles (+4.9%) and Metcash (+3.6%) both rose, while Woolworths (+6.3%) had its best session in about five years.

That was after the ACCC released its report after its year-long inquiry into the supermarket sector, which revealed Australia's supermarkets to be among the world's most profitable, and indicated the dominance of the two major players was set to continue.

Here are the details of what the regulator found, and why it was treated as relatively "benign" by investors, from business reporter Emilia Terzon:

Loading...But, as chief business correspondent Ian Verrender wrote, we've been here before, and the dominance of just a few major players isn't an anomaly for Australia:

ASX dips, banks rise, James Hardie tumbles

The ASX 200 has made up a bit of lost ground to be down 0.1% to 7,921 points at 12:45pm AEDT.

The broader All Ordinaries index is down 0.2% to 8,143 points.

Financials are doing most of the heavy lifting, while on the other end of the ASX barbell, the miners have largely been a dead weight.

The miners have been dragged down by falling Chinese economic sentiment and lower bulk-material prices (although copper managed to eke out a rise on Friday).

BHP was down 0.8%, while Fortescue and Mineral Resources bucked the trend.

Fortescue (+1.7%) benefited from a broker upgrade from UBS, while Mineral Resources (+2.8%) has reopened its Onslow Iron Project haulage operations after another road train tumbled off the unsealed road last week.

Supermarkets have given up a bit of last week's gains as investors have realised that while they may have dodged a bullet with the ACCC report, it is business as usual in the grocery game.

Banks and insurers have avoided selling pressures this morning and have been the biggest positive on the overall market, with only Macquarie (-0.3%) significantly down.

Investors haven't warmed to James Hardie's (-12.6%) announcement of a $14 billion merger with NYSE-listed AZEK.

NRW Holdings (-3.1%) and New Hope (-6.1%) both went ex-dividend this morning.

But the biggest casualty this morning is mortgage insurer Helia (-26.2%) on news it may lose its contract with CBA as the bank noted it was shopping around for alternative mortgage insurers.

Mineral Resources is biggest gainer this morning, while Telix Pharmaceuticals is up 2.6% after the US FDA approved its next generation prostate cancer diagnosis kit for use.

Qantas (+2.2%) has also regained a bit of altitude in the midst of global sell-off in aviation stocks.

Market snapshot

- ASX 200: -0.1% to 7,921 points (live values below)

- Australian dollar: +0.3% to 62.85US cents

- Asia: Nikkei +0.2%, Hang Seng +0.3%, Shanghai +0.1%

- Wall Street (Friday): Dow +0.1%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX -0.5%, FTSE -0.6%, Eurostoxx -0.5%

- Spot gold: flat at $US3,024/ounce

- Brent crude: -0.3% to $US71.97/barrel

- Iron ore (Friday): -0.6% to $US99.90 a tonne

- Bitcoin: +0.5% to $US85,626

Prices current around 12:45 pm AEDT

Live updates on the major ASX indices:

US Treasury bond sell off

Why are treasurey bonds being sold off in the US MARKETS

- chrisso

Very good question Chrisso.

For an answer, I'll appropriate a line from NAB's senior FX strategist Rodrigo Catril who studies such things.

In today's pre-market morning note, Mr Catril wrote:

The FOMC announcement our Thursday morning was one big factor for the move lower in yields where Chair Powell saw the impact of tariffs on inflation as "transitory". NY Fed President Williams and Chicago Fed President Goolsbee reiterated that message on Friday, noting any inflationary impact from tariffs has the potential to be short-lived.

Hope that helps.

ASX scrambles back to par

Woo hoo! The ASX has scrambled back into positive territory, albeit briefly, up 1 point at midday. (It's now submerged back into the red down 5 points, but still not too bad).

James Hardie and Helia lead ASX lower, banks stronger

The ASX 200 has opened 0.3% lower despite a spurt of buying in financial stocks.

Financials were one of the 3 sectors to have made ground this morning, while selling in miners and building materials business James Hardie have weighed down the index.

The miners have been dragged down on falling Chinese sentiment and lower bulk material prices (although copper managed to eke out a rise on Friday).

BHP and Rio Tinto are down 1.3% and 0.6% respectively.

Supermarkets have given up a bit of last week's gains as investors realised while they may have dodged a bullet with the ACCC report, it was business as usual in the grocery game.

Banks and insurers have avoided selling pressures this morning and have been the biggest positive on the overall market.

Investors haven't warmed to James Hardie's (-9.4%) announcement of a $14 billion merger with NYSE-listed AZEK.

But the biggest casualty this morning is mortgage insurer Helia (-28%) on news it may lose its contract with CBA as the bank noted it was shopping around for alternative mortgage insurers.

Education provider IDP Education is the biggest winner so far (+1.6%), while Qantas (+1.4%) has regained a bit of altitude in the midst of global sell-off in aviation stocks.

ASX opens 0.3% lower

The ASX 200 has opened 0.3% lower at 7,907 points.

There have been a couple of notable casualties this morning.

James Hardie is down 9% after announcing a $14 billion cash and scrip deal to merge with NTSE-listed AZEK.

Mortage insurer Helia is down 28% after warning investors it may lose its contract with CBA.

Market snapshot

- ASX 200: -0.3% to 7,907 points (live values below)

- Australian dollar: +0.2% to 62.748US cents

- Wall Street (Friday): Dow +0.1%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX -0.5%, FTSE -0.6%, Eurostoxx -0.5%

- Spot gold: flat at $US3,024/ounce

- Brent crude: flat at $US72.16/barrel

- Iron ore (Friday): -0.6% to $US99.90 a tonne

- Bitcoin: +0.4% to $US85,528

Prices current around 10:20 am AEDT

Live updates on the major ASX indices:

ICYMI: Kohler's federal budget preview

Here's a handy 2-minute primer on tomorrow's federal budget from our guru-in-residence Alan Kohler.

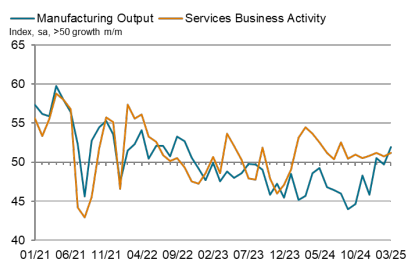

Loading...Australian business activity accelerates

Business activity growth in Australia accelerated at the end of the first quarter of 2025, buoyed by improvements in both the manufacturing and service sectors, according to the latest Purchasing Managers' Index (PMI) survey from S&P Global.

The March composite survey of both manufacturing and services sectors showed an expansion in private sector output for the sixth consecutive month.

The PMI reading of 51.3 was well up from February's 50.6, where 50 points markets the line between expanding and contracting activity, and the fastest expansion since August last year.

Manufacturing expansion accelerated to its highest level in 28 months.

Economics Associate Director at S&P Global Market Intelligence Jingyi Pan said the March data outlined improvements in Australia's private sector growth at the end of the first quarter of 2025.

"While modest, the rate of output growth accelerated to the fastest in seven months and was notably supported by broad-based expansions across both the manufacturing and service sectors," Ms Pan said.

"Although export orders declined amidst weather disruptions and subdued external conditions, the improvements in domestic demand more than made up for it, contributing to the most pronounced increase in new orders in almost three years."

This week: The federal budget and more inflation insights

Australia:

Mon:

Purchasing Managers' Indexes (Mar)

Tue:

Federal budget

Wed:

CPI indicator (Feb)

International:

Mon:

CH — Medium term lending facility rate

US — PMIs

Tue:

US — Home prices (Jan) Home sales (Feb)

Wed:

US — Durable goods orders (Feb)

Thu:

US — GDP (Dec qtr.)

Fri:

US — Core PCE index

Tuesday's federal budget is the big item of the week.

Budgets are not necessarily market movers, and many initiatives have already been announced, but this one is especially important as it drops ahead of the soon-to-be announced federal election.

A budget deficit is assured this time around, but improving economic conditions may mean it may not be as large as the $27 billion forecast in December's MYEFO statement.

New spending will be poured over for any impact on inflation, although rolling over the Energy Bill Relief Program may help bring down headline inflation.

Speaking of inflation, the ABS's monthly CPI indicator is published on Wednesday.

The consensus view is the February figure will come in unchanged at 2.5%, a fairly comfortable spot for the RBA.

Offshore, US core PCE inflation — the Fed's preferred measure — is released on Friday and is forecast to remain at a fairly solid 0.3% rise over the month.

James Hardie says it is buying growth in the US

A bit more on the big $14 billion deal in the US that James Hardie has just announced.

James Hardie CEO Aaron Erter says the deal is a "an extraordinary opportunity to accelerate our growth strategy ... and drive shareholder value."

Mr Erter says James Hardie and AZEK are highly complementary businesses with a substantial opportunity to drive cost synergies.

In a statement to the ASX this morning, James Hardie said the deal will unlock around $US125 million in cost synergies and at least $US300 million in commercial synergies.

The statement noted the deal had unanimous support of both company boards.

Mr Erter will serve as the combined companies CEO, while James Hardie's Chief Financial Officer Rachel Wilson will continue in her role.

AZEK will gain three members on the combined board.

Once the deal is completed James Hardie's ordinary shares will be listed on the New York Stock Exchange, while it will maintain its current CDI listing and index inclusion on the ASX.

James Hardie to buy US business in $14 billion deal

The big building supplies manufacturer James Hardie has announced it will buy the Wall Street listed AZEK Company for $US8.8 billion ($14 billion) and create a combined US entity.

AZEK is described as a leading manufacturer of low-maintenance and environmentally sustainable outdoor living products.

The deal will see James Hardie acquire AZEK with a combination of cash and shares.

The overall price represents a 26% premium to AZEK's 30-day average trading price.

On completion of the transaction James Hardie and AZEK shareholders will own 74% and 26% respectively of the combined company.

ASX set to slip as Wall Street closes flat

Wall Street hit the pause button at the end of the week, as the news flow slowed to a trickle — even the Trump administration had little to say for once.

If there was a headline it was probably a positive one along the lines that President Donald Trump said there would be flexibility on tariffs, something the market understood to mean they may be less brutal than first feared.

The S&P 500 and Dow both edged up 0.1%, while the Nasdaq gained 0.4%.

The S&P 500's 0.5% rise over the week also ended a four-week losing streak on Wall Street.

However, Wall Street's gain only came late in the session after a flurry of buying in the tech sector, driven more by "short covering" rather than a change in sentiment.

"On a day devoid of major economic data releases, US equities had a volatile session with the S&P 500 down close to 1% before a tech led rally lifted the index back into positive territory during the last hour of trading," NAB's senior FX strategist Rodrigo Cateril wrote in a morning note.

"Traders put the recovery down to short covering, rather than fundamental forces, ahead of the triple witching option expiry (Bloomberg noted that over 21 billion shares changed hands on US exchanges — the most in 2025),' he wrote.

"Indeed, the recovery in equities can be put down to technical drivers rather than a change in fundamentals.

"At the company levels, the news was not encouraging.

"FedEx Corp. shares dropped after the parcel delivery company reduced full-year earnings forecast for a third consecutive quarter, Nike warned it expects a fall in margins during the current quarter given US tariffs on products from China and Mexico.

"And Lennar Corp triggered a selloff among homebuilding shares after the company's guidance came below expectations.

European markets were generally weaker on Friday, giving up a chunk of their recent gains.

The ASX's solid run — it gained almost 2% last week — looks like coming to a halt with the S&P/ASX 200 futures down 0.5% this morning.

Oil ended the week higher (+0.2%) as the US announced new tougher sanctions on Iranian export to China.

The latest production plan from the OPEC+ cartel, suggesting tighter supply ahead, also helped to push crude prices higher.

Good morning

Good morning and welcome to another week on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, it looks like a disappointing start to the week – ASX futures point to a 0.5% decline on opening after Wall Street’s uninspiring end to the week.

It’s budget eve, so financial machinations in Canberra will be a focus today, but there is a raft of global manufacturing data to be released, including Australian and Japanese PMIs we’ll keep our eyes on.

As always, the game’s afoot, so let’s get blogging.

Loading