NAIROBI, Kenya, Mar 21 – The country’s pension industry is urging regulatory bodies to introduce innovative investment opportunities that can accommodate the increasing pool of funds held by pension and insurance firms.

The Public Service Superannuation Fund (PSSF), a state-run contributory pension scheme, says that as the country’s working population continues to grow, so too will pension assets, necessitating secure and profitable investment avenues.

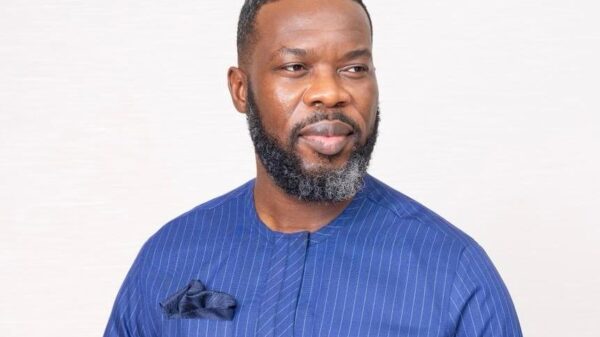

However, PSSF CEO Jonah Aiyebei highlights the challenge of limited local investment options, questioning whether Kenya’s economy is expansive enough to absorb these funds.

“A challenge that comes in is the investment opportunities. Is our economy big enough to absorb these investable assets?” Aiyebei posed.

With over Sh1.7 trillion in assets under management as of 2023, pension funds are actively exploring alternative investments, including infrastructure, private equity, and green energy, to ensure long-term financial stability for retirees.

Aiyebei called on capital market practitioners and pension industry players to spearhead innovative financial instruments that will provide attractive returns while fostering economic growth.

“Because of this challenge, it calls on the practitioners in the capital market space and also the players in this space, even the pension funds themselves, to be very innovative and come up with new products that can attract proper investments for pension funds.”

The fund argues that structured investments in long-term projects would not only benefit pensioners but also reduce the government’s financial burden on social protection programs.

The National Treasury has also challenged pension schemes to consider Public-Private Partnerships (PPPs) as a means of financing major infrastructure projects, rather than relying on external borrowing.

While acknowledging discussions around funding government projects, PSSF says there is still no clear framework on how pension money would be recouped.

“There have been a lot of discussions on funding infrastructure. But at this point, we have not made a commitment. We have not really got the actual fundraising strategy of the promoters for us to say we can set aside this amount of money,” Aiyebei stated.

PSSF, which became operational in 2021, has grown its value to Sh187.65 billion as of December 2024, with a membership of 443,379 contributors, including teachers, civil servants, and disciplined service officers.

Over the past decade, the government’s pension liability has surged dramatically. In 2017-2018, the state allocated Sh71.9 billion for pension expenditure, but within five years, this had nearly doubled to Sh140.7 billion a 96 percent increase.

This rising financial burden prompted significant reforms in the pension sector, with the government pushing for alternative financing models that ensure sustainability.

Aiyebei insists that continuous innovation is crucial in securing pension assets and ensuring they deliver optimal returns for contributors.

“So there is a need for innovation. There is a need for continuance, looking for proper vehicles that can deliver an effective return for members,”he said.