Active Super fined for greenwashing, ASX closes higher, gold above $US3,000 an ounce — as it happened

Australia's share market closed slightly higher on Tuesday, with gold prices surpassing the $US3,000 an ounce mark — setting a new record high as investors seek cover from economic concerns fuelled by US President Donald Trump's tariffs and wider geopolitical instability.

Meanwhile, superannuation fund Active Super (now merged with Vision Super) has been directed by the Federal Court to pay a penalty of $10.5 million for making misleading claims about its environmental conduct, known as "greenwashing".

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

ASX 200: +0.1% to 7860.4 points

- Australian dollar: Flat at 64 US cents

- Dow Jones: +0.8% to 41,841.6 points

- S&P 500: +0.6% to 5,675.1 points

- Nasdaq: +0.3% to 17,808.6 points

- FTSE: +0.6% to 8,680.2 points

- EuroStoxx: +0.8% to 5,445.5 points

- Spot gold: +0.4% to $US3,012.7/ounce

- Brent crude: +0.5% to $US71.40/barrel

- Iron ore: Flat at $US102.65/tonne

- Bitcoin: -1.3% to $US82,997.21

Prices current around 4.55pm AEDT

That's all for today

That's all from the business team today.

It's hard to stay upbeat with all the uncertainty surrounding markets and the economy at the moment, but as a wise person once said...

LoadingASX200 closes slightly higher, gold 'safe haven' hits record

Australia's share market closed only slightly higher on Tuesday, erasing gains made earlier in the day amid tensions in the Middle East and a Gaza ceasefire deadlock breaking.

The S&P/ASX 200 index closed 0.1 per cent higher at 7860.4 points.

Jittery investors are now heading for safe haven investments like gold, as investors seek cover from economic concerns fuelled by US President Donald Trump's tariff policies and as negotiators try to mediate a ceasefire deal.

Gold prices surpassed the $US3,000 an ounce mark on Tuesday, setting a new record high.

Traditionally viewed as a safe asset against economic and geopolitical instability, gold has gained over 14 per cent so far this year, and bullion has hit a record high 14 times.

According to a research note on Tuesday, ANZ raised its zero to 3-month gold price forecast to $3,100 per ounce and 6-month forecast to $3,200 per ounce.

ANZ's forecasters say "we maintain our bullish view (on gold), amid strong tailwinds from escalating geopolitical and trade tensions, easing monetary policy, and strong central bank buying".

The gold price was trading at $US3,010.6 an ounce around market close on Tuesday.

Qantas cabin crew win pay rises of up to $20,000

More than 750 Qantas flight attendants employed via labour hire companies will receive pay rises of up to $20,000 after their union capitalised on the Labor government's "same job, same pay laws" to secure the wage increases.

Cabin crew employed by these labour hire companies will now earn the same pay as their colleagues employed directly by Qantas.

For Qantas Domestic cabin crew, the increase in base pay — excluding allowances — is worth up to $20,000 a year.

The lift in hourly pay for casual workers employed by Maurice Alexander Management (MAM), and Altara is between 32 and 42.5 per cent, excluding allowances.

The first pay rises are set to kick in with an uplift in allowances starting from next month, before a full increase to base pay coming into effect from July 14 for Qantas Domestic staff and August 11 for Maurice Alexander Management (MAM) and Altara employees.

"This result demonstrates what can be achieved when companies like Qantas sit down and work with their employees," FAAA Federal Secretary Teri O'Toole said.

"Qantas has shown that big business can lead the way and do things better, and we welcome the change under Vanessa Hudson's leadership."

Ms O'Toole said the "Same Job Same Pay" laws had changed the lives of working cabin crew, but that Federal Opposition Leader Peter Dutton wants to repeal these laws.

Gold prices climb amid Trump's tariffs

Gold prices have broken above $US3000 an ounce.

ABC Bullion general manager Jordan Eliseo spoke with Alicia Barry. He says US President Donald Trump's tariffs are a significant factor in the uptick of gold prices and demand.

You can watch the interview here:

Roy Morgan survey suggests unemployment rate increased to 11.5%

In February, Australian 'real' unemployment increased 214,000 to 1,834,000 (up 1.4 per cent to 11.5 per cent of the workforce) with significantly more people looking for work, according to a Roy Morgan survey.

Roy Morgan’s unemployment figure of 11.5 per cent is clearly more than double the ABS estimate of 4.1 per cent in January and roughly in line with the combined ABS unemployment and under-employment figure of 10.1 per cent.

The driver of the increase in unemployment in Roy Morgan's survey were the large falls in full-time employment, down 273,000 to 9,356,000, and a drop in part-time employment, down 99,000 to 4,767,000, which forced many people in the labour market into looking for new work.

The February Roy Morgan Unemployment estimates were obtained by surveying 935,035 Australians aged 14 and over between December 2008 and February 2025.

A person is classified as unemployed if they are looking for work, no matter when. The 'real' unemployment rate is presented as a percentage of the workforce (employed & unemployed).

“Since the last Federal Election in May 2022 the population and workforce have both increased by over 1.5 million and well over 800,000 jobs have been created in under three years," said Roy Morgan CEO Michele Levine.

"The soaring population has meant record strong employment growth over the last two years and has been far faster than the long-term average population growth of under 300,000 per year so far this century.

"As well as the disruptions caused by the pandemic and the subsequent population growth, a ‘cost of living crisis’, as inflation and interest rates hit multi-decade highs, has forced many people to seek employment, or stay in the labour force longer than expected to make ends meet."

I looked at how difficult the market has become for jobseekers when last month's ABS data was released showing the unemployment rate jumping to 4.1 per cent.

You can also listen to this podcast I did with ABC News Daily about why it's getting tougher to find a job, and why some jobseekers describe the job hunt as a similar process to online dating.

Energy Vault acquires battery project in NSW

United States-based energy storage solutions company Energy Vault has signed a deal to purchase the Stoney Creek battery energy storage project from Victoria-based renewable energy developer Enervest.

Energy Vault is looking to build its presence in Australia's rapidly growing energy storage sector and announced on Tuesday it has agreed to acquire the estimated $350 million Stoney Creek battery energy storage system (BESS) project located in Narrabri, NSW.

According to Energy Vault, the Stoney Creek BESS has been awarded a 14-year Long-Term Energy Service Agreement by the Australian Energy Market Operator Services.

"The acquisition of Stoney Creek marks a significant milestone for Energy Vault in Australia, as well as an acceleration of our global 'Own & Operate' growth strategy, designed to deliver sustainable, long-term revenue streams with high cash flow generation," said Robert Piconi, chairman and chief executive of Energy Vault.

"We look forward to delivering long-term benefits to NSW's electricity market and consumers for many years to come."

Enervest CEO Ross Warby said they would transfer ownership of Stoney Creek BESS to Energy Vault while continuing to provide end-to-end technical and development services.

"This ensures a structured transition to financial close and the delivery of a high-quality infrastructure project for the North-West Slopes region," he said.

Treasurer hoses down expectations for the federal budget

Treasurer Jim Chalmers is hosing down expectations on revenue for the federal budget next week.

In a speech ahead of Tuesday's federal budget, Mr Chalmers flagged that Treasury does not expect the bottom line to "change very substantially" from the December mid-year budget update, which forecast a $33 billion deficit for 2024-25.

The direct hit to gross domestic product of steel and aluminium tariffs imposed on Australia by US President Donald Trump last week would be "manageable", Treasury said.

It estimates the tariffs would take a 0.02 per cent chunk out of GDP by 2030 — roughly half a billion dollars of today's economic output. You can read more on that in this story Treasurer issues grim message on economy if trade war takes hold.

And watch The Business interview below from last night with leading economist Chris Richardson for more about what the budget holds and why consecutive governments have failed in their budget decisions.

Active Super hit with penalty for greenwashing

Superannuation fund Active Super has been directed by the Federal Court to pay a penalty of $10.5 million for making misleading claims about its environmental conduct, known as "greenwashing".

In June 2024, the Federal Court found that Active Super contravened the law when it invested in various securities that it had claimed were eliminated or restricted by its environmental, social and governance (ESG) investment screens.

Active Super claimed in its marketing that it eliminated investments that posed too great a risk to the environment and the community, including gambling, coal mining and oil tar sands.

Following the invasion of Ukraine, Active Super also made representations that Russian investments were "out".

But corporate watchdog ASIC said that contrary to these representations, Active Super held direct and indirect investments in companies such as SkyCity Entertainment Group (gambling), Gazprom PJSC (Russian entity), Shell Plc (oil tar sands) and Whitehaven Coal (coal mining).

ASIC Deputy Chair Sarah Court said the case demonstrated ASIC's commitment to taking on misleading marketing and greenwashing claims made by companies.

"It is our third greenwashing court outcome, and we will continue to keep greenwashing in our sights,'" she said.

The Federal Court's Justice O'Callaghan noted that the contravening conduct continued "over an extensive period of time" (about two and a half years) and that it was likely to have led to investors losing confidence in ESG programs.

On 1 March, Vision Super and Active Super merged into one fund that now has over 165,000 member accounts and about $30 billion in funds under management.

In recent years, regulators including ASIC and the ACCC have been taking greenwashing more seriously. More on that here:

Months-long lags in full interest rate cut impact

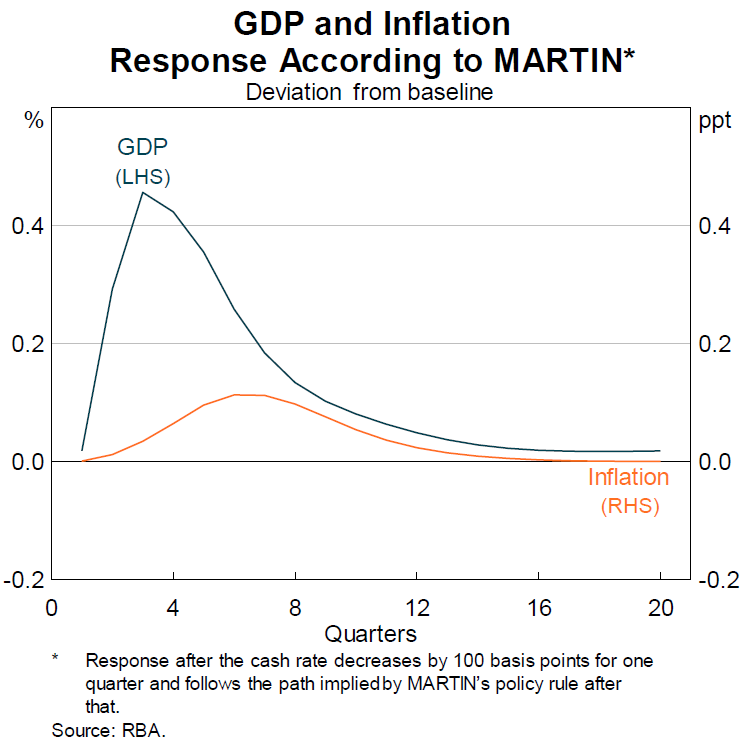

In RBA assistant governor Sarah Hunter's speech today, she quantified the lag between when the Reserve Bank changes interest rates, and when the resulting economic impact peaks.

Dr Hunter says the central bank's modelling shows that it takes nine months for a rate move to have its biggest effect on economic growth.

It takes around twice that long for it to have its peak effect on inflation.

"This could be because it takes time for an increase in demand to affect the hiring decisions of firms and the job search decisions of households, which then ultimately feed into price setting. Or it may simply reflect some 'stickiness' in prices," Dr Hunter said.

Here's a chart showing the lag:

"This tells us that – according to [the RBA's main macroeconomic model] MARTIN at least – the decisions we make today will have their largest effect on economic output at the end of 2025, and on inflation in mid-2026."

You can read more on the speech from business reporter David Taylor here:

NAB CEO warns Trump's 'tariff madness' may end rate cuts

Australia may be at the end of its cycle of interest rate cuts if the "tariff madness" instigated by US President Donald Trump escalates into a global trade war, according to NAB CEO Andrew Irvine.

Last month, Australia cut interest rates for the first time since November 2020, to 4.1 per cent.

NAB is forecasting two rate cuts in the latter half of 2025.

Mr Irvine says if global inflation picks up, interest rates will not fall.

"We're not an island," Mr Irvine told the Australian Financial Review Banking Summit.

"If this tariff madness does happen, we could be at the end of reductions [in Australia]."

In a letter to customers this week, Mr Irvine also noted "interest rates have peaked. If so, we're now in a downward cycle on borrowing costs".

Ian Verrender wrote a detailed analysis today on the Reserve Bank's chief economist saying current economic uncertainty, especially around US tariffs, makes forecasting and rate setting more difficult. You can read that below

-with Reuters

Westpac expands fund for women in business

Westpac's $500 million female entrepreneurs fund will be expanded by another $500 million to $1 billion, to further address the challenges faced by women accessing finance to start or grow a business, the big four bank says.

The fund, launched two years ago, hit its $500 million target, supporting 1,155 women across a range of industries.

"We know that female business leaders believe it's harder for women to get finance than it is for men," according to Tamara Bryden, Westpac's managing director, business lending.

"I think our bankers also understand the barriers that women face when starting a business, such as unconscious bias, which may discourage them from seeking finance."

Westpac's Women in Business research shows nearly half (45 per cent) of female SME business leaders have started a business from scratch, compared to 27 per cent of their male counterparts.

The research, commissioned by Westpac and conducted by Lonergan Research in October 2024 surveyed SME business leaders throughout Australia.

It found 94 per cent of women view running their own business as a path to wealth and financial independence and nine in 10 believe that the social impact of their business is as important as the economic impact.

Data from Cut Through Venture shows that in 2024, just 2 per cent of $4 billion of venture capital raised in Australia went to all-female founded teams and just 15 per cent of investments went to startups with at least one woman in the founding team.

Despite US President Donald Trump's executive order for US companies operating globally to wind back diversity and inclusion policies, some local investors want mandatory reporting and/or quotas introduced whereby venture capital firms that fail to meet certain diversity targets get financially punished. You can watch my report on that here:

Rex Airlines sells flight simulator, single aircraft for $17.5 million

The embattled Rex Airlines has sold off more parts of its business as administrators look to keep it afloat — this time selling off its flight simulator in Sydney and a single aircraft.

In an update shared to the ASX, Rex's administrators said the Boeing 737-800/Boeing 737-700 flight simulator was sold (along with the property that housed it in Mascot, NSW) for $6.1 million.

Administrators also confirmed they had closed on a sale of a Textron King Air 350C aircraft for $11.4 million.

Overall, it's netted the company $17.5 million which administrators will use to pay off Rex's debts. (It owes around $500 million to some 4,800 creditors.)

Rex's administrators have until the end of June to find a buyer for the airline, but last month the federal government confirmed that it would acquire Regional Express if no buyer was found.

If you know more about Rex, please get in touch at Ainsworth.Kate@abc.net.au.

$6.5b boost from reskilling women into tech: report

Women reskilling into tech-based roles could represent a $6.5 billion opportunity for Australian businesses and significant salary increases for employees, according to a report by RMIT Online and Deloitte Access Economics.

The report, based on a nationwide survey of 436 business leaders in December 2024, estimates medium-sized businesses stand to gain a benefit of $278,700 annually, while large companies could see a $1.8 million dividend per year by attracting women into tech roles.

Australian businesses will need 1.3 million tech workers by 2030, yet the current government target is just 1.2 million, a difference of more than 100,000.

The report estimates that they can earn $31,100 more annually, representing a 31 per cent average salary boost to the individual and a $4.3 billion positive wage impact overall.

"Australia's tech talent shortage is a growing challenge, and reskilling women presents a practical, high-impact solution," according to Nic Cola, CEO of RMIT Online.

The report identified that there are more than 660,000 women in Australia who, based on their current occupations and careers, could reskill into tech roles within approximately six months through short courses or on-the-job training.

Rhiannon Yetsenga, Deloitte Access Economics, said generative AI and other technologies presented "an enormous opportunity" but that "Australian businesses cannot capitalise on the benefits of new and emerging tech without access to the right skills".

You can read more about the challenges women in tech face in this story I did about access to funding for female entrepreneurs.

Trade wars see 'lingering' economic risks: NAB

Escalating trade wars and the associated uncertainty create "lingering" economic risks, according to NAB economists.

They say the overall risk of tariffs and slower global growth would be "disinflationary" for Australia, which would lead to falls in our key commodity prices and lower national income.

"Weaker global income growth could also see softer demand for our services exports, such as education and tourism," NAB said.

The bank's forecasts are largely unchanged, with growth returning to trend this year (~2.25 per cent), unemployment rising to 4.25 per cent and underlying inflation settling around 2.5 per cent from mid-year.

"We continue to expect inflation to ease gradually from here (including 0.6 per cent q/q for Q1 underlying inflation) and reach the midpoint of the target band by Q2," NAB said.

"This is more optimistic than the RBA's forecast (0.7 per cent q/q for Q1), which we expect will trigger the next rate cut in May as a result.

"We expect the RBA to gradually ease rates from there, reaching 3.1 per cent in early 2026.

It said a pick-up in household consumption would drive growth closer to its long-run trend over 2025.

"Overall, we expect tariffs and slower global growth to be disinflationary for Australia (via lower commodity prices and national income), though a lower exchange rate would offset some of the weaker income effects," it said.

"However, tariff uncertainty may weigh on consumer and business sentiment."

Village Roadshow files for bankruptcy in the US

Sorry to be the bearer of bad news, film buffs, but Village Roadshow has filed for bankruptcy protection overnight in the US.

The Hollywood production company — which has over 100 titles in its library, including Joker and The Matrix — filed the documents in a Delaware court on March 17.

As for why the company has filed for bankruptcy protection? Village Roadshow says there are two main reasons behind its financial decline:

- 1.An ongoing arbitration dispute with Warner Bros. Entertainment over the release of The Matrix Resurrections that began in February 2022; and

- 2.Unsuccessfully venturing into independent film and TV production from 2018-2020

But it's the dispute with Warner Bros. that's had the biggest impact on Village Roadshow, according to the court documents.

"Even if the WB Arbitration is resolved, the Company believes that it has irreparably decimated the working relationship between WB and the Company, which has been the most lucrative nexus for the Company's historic success in the entertainment industry," the company's chief restructuring officer Keith Maib wrote.

In its bankruptcy filing however, the company says it has a $US365 million "stalking horse bid", suggesting there's at least one interested party in snapping up its library.

The bankruptcy filing comes after a challenging few months for Village Roadshow, including its CEO stepping down, several rounds of job cuts, and Writers Guild of America members being prohibited to work for the company over unpaid contracts.

(And on the off chance you're a high-profile Hollywood exec reading this, let the record show I'd watch a film about this in the future.)

LoadingThe US entity is linked to but different to the Australian company which operates cinemas and theme parks.

Trust? Some problems

The annual Edelman's Trust Barometer is a fascinating assessment of global attitudes and perceptions toward four institutions — government, media, business, and NGOs.

The globe-trotting mega-public relations firm has just released its latest look.

Trust and the Crisis of Grievance is the 25th annual report and took in more than 32,000 respondents across 28 countries.

Here's some of the key Australian findings: a "growing trust crisis in Australia with widespread grievance" among the institutions.

Some of the key themes from the report are:

- A crisis of grievance: There is a rising fear of discrimination, affecting 1 in 2 Australians, and a belief that hostile activism is a legitimate course of action for change (attacking people online, intentionally spreading disinformation, threatening or committing violence, or damaging public or private property).

- Business amid the crisis of grievance: 62% of Australians hold grievances against government, business and the rich, defined by the belief that government and business make their lives harder and serve narrow interests, and wealthy people benefit unfairly from the system while regular people struggle.

- All institutions must work to rebuild trust: Restoring trust requires cooperation between all four institutions. Australians believe NGOs have the best ability to fight divisiveness and repair societal fractures, however, are also seen as being ineffective without broader institutional support.

It's always a fascinating, if not sunny, read. You can find it via the link below.

Bank moves tipped to be Westpac (positive) and NAB (negative)

Some substantial shifts in the executive ranks of Australia's tight "Big Four" banks.

Analysts at Morgan Stanley say it's going to hit the value of stocks.

They believe the appointment of Nathan Goonan as Westpac Chief Financial Officer (CFO) is positive for the bank given his experience and track record as finance chief of National Australia Bank.

On the flipside, the departures of both Goonan and Rachel Slade — who was head of business and private banking as well as an aspirant for the CEO job that went to Andrew Irvine — is seen as negative for NAB in the near term.

Listen to the full interview

If you missed Radio National Breakfast, listen back to the full interview with Jim Chalmers through this link.

Tariffs 'manageable' says Treasurer

The hit to the Australian economy from US President Donald Trump's tariffs on steel and aluminium will be manageable, the treasurer says.

The tariff is a tax on imports into the US, increasing the price to make it less competitive against domestic manufacturers.

Treasurer Jim Chalmers had his department model the impacts and described them as "concerning but manageable".

"It's the broader, indirect impacts that come from this serious escalation of trade tensions around the world, which is much more concerning to us.

"This is a new world of uncertainty, and the pace of change in the world when it comes to rewriting the rules of global economic engagement has quickened since the new administration took office in the US."