The US CPI (Consumer Price Index) data shows inflation eased to 2.8% in February, a positive surprise as it is below the expected 2.9% Year over Year (YoY).

This softer-than-expected inflation print boosted risk appetite, as traders now see an increased probability of rate cuts by the Federal Reserve (Fed) later in the year.

US CPI Below Expectations at 2.8%

Bitcoin (BTC) responded with a modest upward move, jumping to $83,371. The surge comes as lower inflation reduces the likelihood of further tightening and supports risk-on sentiment. Stock markets also reacted positively, with major indices posting gains following the release.

While inflation cooled in February, the Core CPI came in at 3.1% YoY, also beating estimates of 3.2%. Core inflation excludes volatile items like food and energy. Notably, this marks the first decline in headline and Core CPI since July 2024 and suggests inflation is cooling down in the US.

If inflation continues to trend lower, the Fed could shift to a more dovish stance, potentially opening the door to more liquidity entering the markets. Meanwhile, the reaction for traditional assets was as expected, with the US dollar and Japanese yen dropping.

“Both overall and core are down! This clearly raises expectations for an interest rate cut. Both interest rates and the dollar/yen exchange rate responded with declines. This will be positive for stock prices,” an analyst on X observed.

Some analysts are taking these inflation numbers with a pinch of salt, as Donald Trump’s trade tariffs could lead to higher consumer prices.

Notwithstanding, many analysts view the latest inflation data as a tailwind for Bitcoin, which has historically benefited from easier monetary conditions. Now, all eyes are on the Fed’s upcoming policy guidance as traders look for confirmation that the path to rate cuts is opening up.

“A high print would not be very welcomed (as usual). Especially during uncertain times in the market like now, this kind of economic data usually has an increased impact. A high number would likely move the bond yields back up which is the opposite of what the administration is seemingly trying to achieve currently. Then there’s also FOMC next week and the Fed will definitely be looking at this CPI print as well,” analyst Daan Crypto Trades remarked.

Meanwhile, this CPI data comes after a good JOLTS (Job Openings and Labor Turnover Survey) report on Tuesday, which gave the market a reason to stop falling. Notably, Fed Chair Jerome Powell stated on Friday that the US central bank would take a cautious approach to monetary policy easing, adding that the economy currently “continues to be in a good place.”

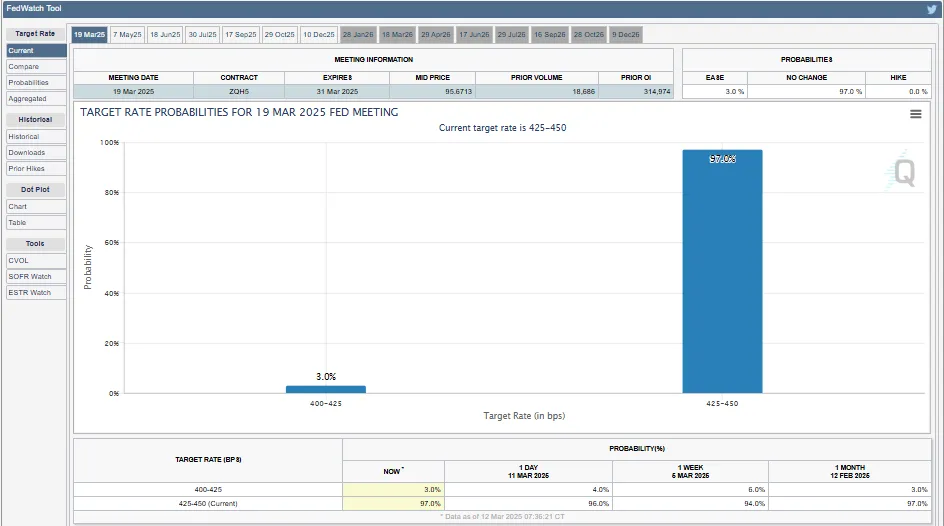

According to data from the CME Fedwatch tool, markets are betting that the Fed will keep interest rates steady at the next meeting. However, some analysts hold that cooling inflation could warrant a rate cut.

“Inflation just came in at 2.8% which is lower than expectations. The real number is even lower. The Fed should cut rates immediately,” chimed Anthony Pompliano, the founder of Professional Capital Management.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.