An almost immediate reaction to the Coronavirus outbreak in China and throughout most of the world has sent shock waves through the global markets – particularly seen in shipping and oil. The actions within China to attempt to contain the virus spread include shutting down entire cities and setting up mass quarantine events. It is estimated that as many as 8+ million people were quarantined within cities in China throughout the Chinese New Year.

Chinese President Xi Jinping warned recently that the Coronavirus, and the efforts to stop it, may greatly reduce the Chinese economy over the next few months. The President Xi urged top officials to refrain from “more restrictive measures” to contain the virus. It is our opinion that more restrictive measures are essential to contain the spread of this virus and that further contraction in the Chinese economy, as well as other economies, are almost set in stone at this point.

Information we've received from some friends living in China and Hong Kong suggests that travel is very restricted, face masks are scarce, people are staying inside their homes and surviving as family units within very close contact with one another. They are scared, trapped and unable to do anything other than try to wait this out. Imagine what this is doing to the local economies, shops, offices and businesses?

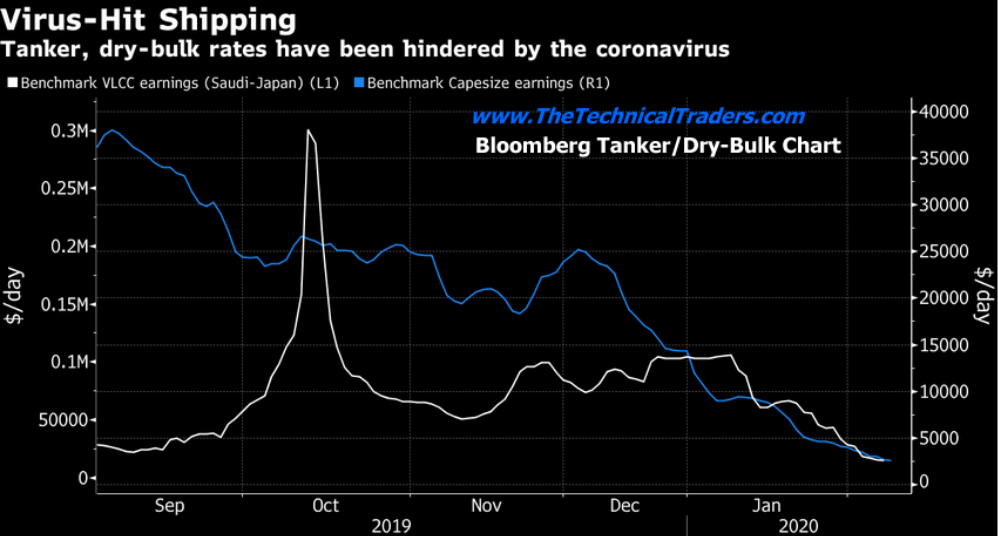

Reflectively, global shipping rates have collapsed over the past 30+ days as one of the first signs of the contraction in the global markets. As of December 31, 2019, both Tanker and Dry-Bulk rates were hovering near $14,000 per day. Now, this rate is near $2,500 per day – a -82% decrease. As you consider the broader aspects of this massive decrease in shipping rates, consider the global contagion event that may setup if the Belt-Road region is adversely hit with the virus.

Source: Bloomberg.com

Shipping stocks are taking a beating. Factories are shut down, the product is not being shipped and as for goods ready to ship, many don't want to take delivery for the time being.

From a short-term standpoint, this sector is looking oversold, but depending on how much the virus spreads we could see another 20% from the current price.

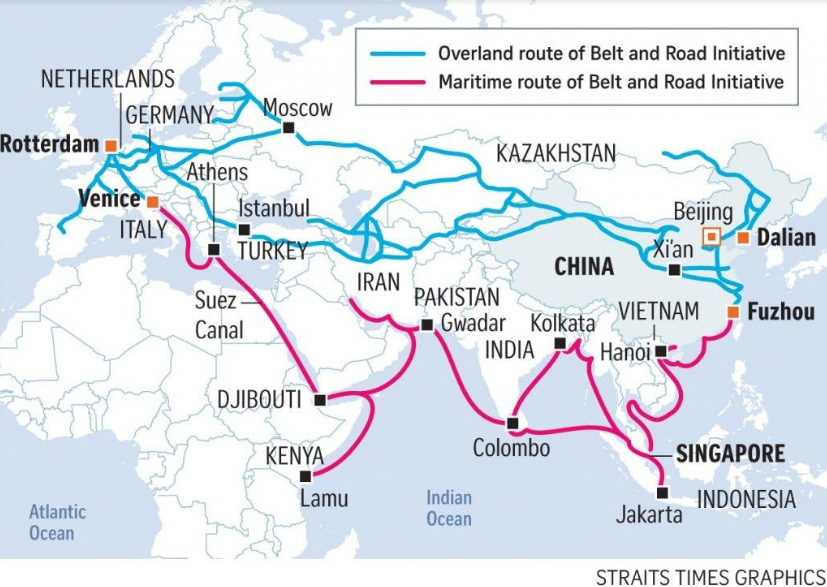

China's Belt-Road Infrastructure Projects

China's Belt-Road initiative consists of massive infrastructure, port and other projects throughout Europe, Asia, India, Pakistan, Iran, Turkey, Russia, Africa and other nations. These projects have been initiated over the past 5+ years and are well underway. We believe the spread of the Coronavirus may follow a path along with the Belt and Road projects and potentially infect a larger number of individuals over the next 30+ days than originally expected. If this virus moves into the Middle East or Africa, containment may become very difficult.

The reality is that Shipping and Commodities could see a dramatic price decline as this virus outbreak continues over the next 60+ days. Reports are already starting to hit the news wires that auto and manufacturing supplies are starting to pile up at ports in China. Without a functioning manufacturing sector and workers to keep everything running, China's economy will grind to a halt very quickly.

This translates into lower oil prices, lower raw material prices and higher metals prices. A capital shift will continue to take place throughout the world where capital will move away from risky environments and toward more secure investment environments. Thus, capital will move away from Asia, India, the Middle East and potentially Europe and toward the USA, Canada and possibly Mexico. Everything depends on what happens over the next 60-to-90+ days.

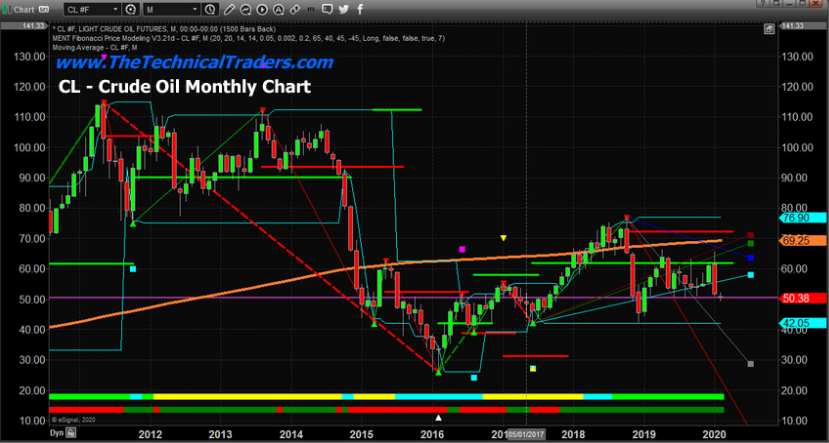

Crude Oil

This Monthly crude oil chart shows how quickly oil rotated lower in January 2020. Currently, crude oil is trading near $50 per barrel and may break lower toward the $44 to $46 price level before finding any real support. Overall, our research team believes that oil may reach as low as $35 to $36 ppb before reaching a bottom. You can read our earlier research here. Within that research, dated November 19, 2019, we highlighted our earlier predictive modeling research from July 2019 suggesting oil would break substantially lower in November 2019 and again in February 2020. We predicted this downside move in oil nearly 8 months before it happened.

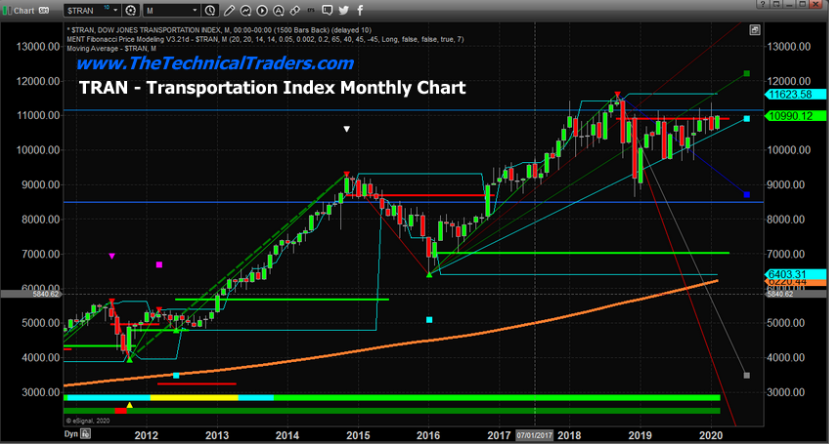

This monthly Transportation Index chart highlights the sideways FLAG formation setting up in the U.S. Transportation sector. If the U.S. market breaks lower as a result of slower global economic activity, we think that we will see the Transportation Index fall very quickly to levels below $9,500. A breakdown in the that index would be an early warning sign that the U.S. economy is headed toward a recession or contraction. Global shipping has already confirmed this event is taking place – yet the U.S. transportation sector has not shown much weakness.

Traders need to be aware of the risks in the markets and of the continued capital shift that is taking place around the globe. Capital is running away from risk and pouring into more stable markets. The ultimate risks to the global economy are for those nations where debt/economy levels are fragile, which is why we highlighted the Belt Road project. If China enters a protective mode where its central bank attempts to bail out Chinese companies/initiatives, we believe the Belt Road project could become a great risk. And we think that this could happen very quickly given the current market environment.