Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 9 months of this year through September 30th the Standard and Poor’s 500 Index returned approximately 20% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 24% during the same 9-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Ardmore Shipping Corp (NYSE:ASC).

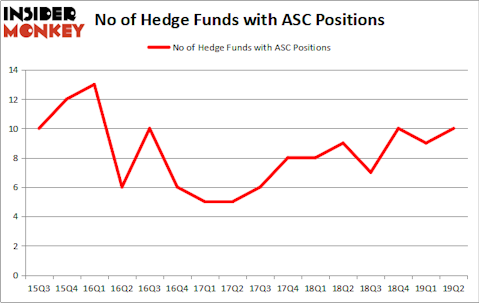

Ardmore Shipping Corp (NYSE:ASC) was in 10 hedge funds’ portfolios at the end of the second quarter of 2019. ASC shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. There were 9 hedge funds in our database with ASC positions at the end of the previous quarter. Our calculations also showed that ASC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a look at the new hedge fund action regarding Ardmore Shipping Corp (NYSE:ASC).

What does smart money think about Ardmore Shipping Corp (NYSE:ASC)?

At the end of the second quarter, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in ASC a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the biggest position in Ardmore Shipping Corp (NYSE:ASC), worth close to $13.3 million, comprising 0.1% of its total 13F portfolio. The second largest stake is held by George McCabe of Portolan Capital Management, with a $5.4 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass Renaissance Technologies, Noam Gottesman’s GLG Partners and Ken Griffin’s Citadel Investment Group.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Ardmore Shipping Corp (NYSE:ASC) headfirst. Citadel Investment Group, managed by Ken Griffin, initiated the most outsized position in Ardmore Shipping Corp (NYSE:ASC). Citadel Investment Group had $0.7 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $0.5 million position during the quarter. The following funds were also among the new ASC investors: Paul Marshall and Ian Wace’s Marshall Wace LLP and Vince Maddi and Shawn Brennan’s SIR Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Ardmore Shipping Corp (NYSE:ASC) but similarly valued. We will take a look at Kandi Technologies Group, Inc. (NASDAQ:KNDI), MutualFirst Financial, Inc. (NASDAQ:MFSF), PCB Bancorp (NASDAQ:PCB), and Permian Basin Royalty Trust (NYSE:PBT). All of these stocks’ market caps are closest to ASC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KNDI | 3 | 1929 | 0 |

| MFSF | 3 | 28796 | 0 |

| PCB | 2 | 26436 | 0 |

| PBT | 6 | 10023 | 0 |

| Average | 3.5 | 16796 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.5 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $27 million in ASC’s case. Permian Basin Royalty Trust (NYSE:PBT) is the most popular stock in this table. On the other hand Pacific City Financial Corporation (NASDAQ:PCB) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Ardmore Shipping Corp (NYSE:ASC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ASC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ASC were disappointed as the stock returned -17.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.