Ampio Pharmaceuticals, Inc. (NASDAQ: AMPE) Extended Trial Shows Patients Can Avoid Total Knee Replacement

AMPE has made it known that they are up for sale and if someone doesn’t buy or license the technology soon, they have the capability to proceed on their own.

Ampio Pharmaceuticals, Inc. (NASDAQ:AMPE)

MIAMI, FLORIDA, USA, March 30, 2018 /EINPresswire.com/ -- (EmergingGrowth.com NewsWire) — EmergingGrowth.com, a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies, reports on Ampio Pharmaceuticals, Inc. (NASDAQ: AMPE)

View the complete article including the valuation gap and Investment summary with price target here: http://emerginggrowth.com/ampio-pharmaceuticals-inc-nasdaq-ampe-extended-trial-shows-patients-can-avoid-total-knee-replacement/

STRUT extended trial Results Show Reduction in TKR Surgeries

Possible First Line Therapy Designation

Likelihood of Approval Moves Forward

Big Pharma Opioid Manufacturers and OAK Drug Companies – Ideal Suitors

Risk Adjusted Earnings Model Supports Hefty $5 Billion + Valuation

Ampio Pharmaceuticals, Inc. (AMPE) announced extended clinical trial results from the STRUT study that showed use of AmpionTM lowered the rate of Total Knee Replacement (TKR) surgery by almost 50% over the use of Saline. Although this study was preliminary in nature it’s results were statistically relevant which means that when the study is completed there is a very high likelihood the outcome will be the same on the larger subset of people.

The impact of these results mean that AMPE can add to the list of current drug uses such as reducing pain, reducing inflammation, increasing function, and increasing global assessment. In addition, the company will be able to claim that the drug reduces TKR’s. This is a complete paradigm shift in the treatment of Osteoarthritis of the Knee (OAK) because now it’s viewed as a Disease Modifying Therapy (DMT). Top drug makers for OAK like Johnson and Johnson (NYSE: JNJ), Pfizer (NYSE: PFE), Teva Pharmaceuticals (NYSE: TEVA), and Purdue focus on reducing pain in this patient population through the use of opiates. Another tier of drug companies which include names like Sanofi Adventis (NYSE: SNY) and Flexion (NASDAQ: FLXN) have focused corticosteroids and hyaluronic acid. AmpionTM is a biologic which means it’s synthesized from human proteins and has no addictive properties like opiates and can be used over and over again.

At the completion of this trial AMPE can include in their Biologics License Application (BLA) that use of AmpionTM will reduce the need for a TKR and up to 5 injections MUST be given before a TKR can be performed. The significance of this paradigm shift is that Orthopedic Surgeons will be required to give AmpionTM before a TKR is performed. The assumption that a large sales force will be needed to sell this drug is no longer valid for a DMT that becomes the new standard of care (SOC).

Trial Results

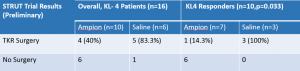

The STRUT study was a randomized, saline vehicle-controlled study to evaluate the safety and efficacy of AmpionTM when administered as three 4 ml inter articular (IA) injections delivered every two weeks. The study involved a total of 47 patients which was done in 2 phases. Phase 1 was a 7 patient single blind phase where all patients received AmpionTM. Phase 2 was randomized on a 1:1 basis with AmpionTM vs Saline. The primary endpoint was change in WOMAC pain between baseline and week 20. Using an IRB approved protocol AMPE followed up with 39 of 45 patients that completed the study 3.5 years later using a telephone questionnaire. The number of severe or KL-4 patients that would need a TKR was 16.

View the chart here: http://emerginggrowth.com/wp-content/uploads/2018/03/AMPE-Pic-1.png

What this chart shows is a statistically significant change in the number of TKR’s performed when using AmpionTM. Using the most conservative results AmpionTM can reduce the number of TKR surgeries by close to 50%. If you combine the two groups the numbers are even more impressive with a 29.4% likelihood of a TKR vs an 83.3% using saline. Keep in mind this data point is 3.5 years after injection. This is the most compelling data ever presented in OAK and KL-4 patients and represents a DMT that should be the new SOC and first-line therapy.

Effect on Orthopedic Landscape – First-Line Treatment Designation

Right now the orthopedic market does conservatively 640,000 TKR’s per year. AMPE is seeking a label for up to 5 injections of AmpionTM as needed. Orthopedic surgeons might have had the opportunity to make a judgement call on performing a TKR surgery instead of using AmpionTM. The release of this new this new data statistically shows that AmpionTM should be the first-line treatment in KL-4 patients before attempting a TKR. Ultimately the FDA makes the decisions on this matter but standard governmental guidelines reveals that any first-line treatment that shows an improvement of 30% over the existing standard of care would likely get the first-line treatment designation. Should AMPE get first-line treatment designation, orthopedic surgeons would be required to use AmpionTM before attempting a TKR. This labeling designation could give AMPE the TKR market on a silver platter.

When doctors see the effect of the drug on the most diseased patients, which is measured in weeks, it’s not hard to envision that use of the drug would be prescribed on less severe indications in place of prescribing opiates, corticosteroids and hyaluronic acid. Since doctors see patients at all stages of disease progression, this could be a real multiplier effect driving off label use of the drug.

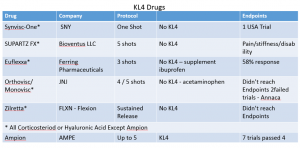

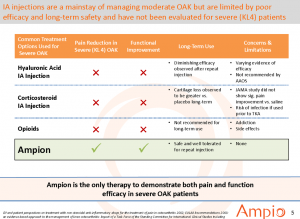

OAK Drug Development Pipeline

There are 3 types of treatment options for KL-4 patients which include Hyaluronic Acid, Corticosteriods, and Opioids. All these existing treatment options depicted in the chart below fell short in clinical trials in reducing pain and increasing functional improvement but the story doesn’t end there. Two major reports written by the Journal of American Medical Association (JAMA) and the American Academy of Orthopedic Surgeons (AAOS) which both state they “do not support use of triamcinolone’”, “we cannot recommend using hyaluronic acid.” With the exception of AmpionTM, all these drugs in the chart below are FDA approved in this indication even though they missed their endpoint in clinical trials. It’s clear that two nationally recognized associations believe that none of these drugs work and a solution is needed. If approved, AmpionTM will be the only drug that actually met its endpoints.

View the chart here: http://emerginggrowth.com/wp-content/uploads/2018/03/AMPE-Picture-2.png

Major pharmaceuticals like Sanofi Adventis (NYSe: SNY), Johnson and Johnson (NYSE: JNJ), and Flexion (NASDAQ: FLXN) have failed to meet their endpoints in OAK but got marketing approval because there really aren’t any good options for patients until the advent of AMPE. None of these drugs work effectively long term and have proven to accelerate the disease progression. Injections do work for a short period but the mechanism of action is essentially taking a thin layer of cartilage and liquefying it to provide temporary relief. This isn’t a good long term solution. It is for this lack of a solution that state reimbursements are drying up for the top drug manufacturers. Another solution is needed and AMPE seems to have it.

View the data here: http://emerginggrowth.com/wp-content/uploads/2018/03/AMPE-3.png

AMPE – Excellent Buyout Candidate for Big Pharma

Current opiate pharmaceutical manufacturers like Johnson and Johnson (NYSE: JNJ), Pfizer (NYSE: PFE), and Teva Pharmaceuticals (NYSE: TEVA) have come under major political scrutiny for their role in creating the opioid epidemic. Last month Trump announced $13 billion to combat the opioid crisis. Big opiate manufacturers like Johnson and Johnson (NYSE: JNJ) are likely to view the purchase of AMPE as not only good publicity but also has the upside of owning a platform technology. Many of these companies if not all were at the JP Morgan (NYSE: JPM) Conference in January and could be in the process of submitting bids to buy AMPE because it would fix the existing political situation and fill the hole left by the drop in sales they have experienced from the inability to market their drugs.

Investors might find that Merck (NYSE: MRK) is also an interesting suitor because it has not voiced plans to pursue its FORWARD trial which it completed in November 2017. MRK has made overtures that the Osteoarthritis Market needed disease modifying modalities that slow or reverse the progression of the disease. In an earlier release of data in the STRUT trial, AmpionTM demonstrated clinically significant cartilage growth of .02mm in as little as 3 months with one injection compared to MRK’s drug Sprifermin which had the same .02mm growth in healthier knees but took 2 years to get to that level.

Likelihood of Marketing Approval

With 1 pivotal trial completed and another phase 3 trial that exceeded the endpoints the BLA has met the prerequisite requirements defined by the FDA AMPE can look forward to the labeling of the drug and eventually approval. The company has indicated on the latest conference call that they have enough money to complete the BLA and expect to have it done by Q3 if not sooner. It was also included as part of their budgeted burn rate which means they are working on it now. There are some great statistics in the pharmaceutical industry that break down the Likelihood of Approval (LOA) and the next milestone for this company is submitting the BLA license. Assuming they have the BLA done and have submitted the file to the FDA, investors can anticipate the probability of approval is 88.4% according to the Biotech Innovation Organization. The market should start factoring this probability into the stock price as time progresses but might need a catalyst.

Valuation and Market Disconnect

At times the market can be very inefficient at price discovery which could lead to huge swoons and falls in price in the presence of a catalyst. In the case of AMPE, the market disconnect from true valuation is more pronounced so it’s important to look at what factors are impeding true price discovery.

The first factor is the markets fear of further dilution. The company did a couple of rounds of what was viewed as dilutive financing. The company stated on the last conference call that they had $11.2 million in cash, access to a credit facility, and over 5 million warrants in the money that have not yet been exercised. This translates into an $830,000 monthly burn rate with enough cash to take them through January 2019.

The next factor deals with AMPE’s ability to get a licensing deal. The market is simply impatient and feels that if the drug is as good as claimed it shouldn’t take so long to get a licensing deal. The absence of a licensing deal announcement has put considerable pressure on the stock. Adding to the pressure is very high level of short interest in the stock with 13.1% of the float short. The stock is number 18 on the largest short position list. There are also “Fake News” reports weighing heavily on the stock price suggesting that AmpionTM is no better than saline playing on investor’s fears that drug approval is not likely. This negative sentiment is weighing heavily on stock price and the catalyst that could break this deadlock is a licensing deal as it puts to rest the issue of dilution and the ability to generate meaningful revenue.

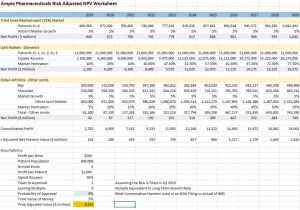

View the risk adjusted NPV worksheet here: http://emerginggrowth.com/wp-content/uploads/2018/03/AMPE-4.png

Net Present Value Model vs Appraisal

The net present value model risk adjusted is a summation of all the future earnings streams and discounted into today’s dollars. Valuations balloon in this model using even the most conservative numbers. Readers should notice the model uses a 9% probability of approval, which is typically the baseline for a New Drug Application (NDA). The profit per dose of $200 is based off the current retail price of Hyaluronic acid which ranges from $300 – $750 per injection. According to AMPE, the label will stipulate up to 5 injections per year which places the profit per patient at $1000 per year. The current risk adjusted model places a $9.533 billion valuation on AMPE using these assumption.

The probability of approval number should be 88.4% and if used in the model with ONLY KL-4 patients yields a risk adjusted value of $6.524 billion.

Although no valuation report was made public, methodology would be the same and include more indication as this model does but with one major caveat. In all likelihood the model DID NOT include 100% market share of the KL-4 patients because that data was just released and the company had indicated the valuation was completed and in the 10 digits.

This last trial data release was a major game changer in valuation because instead of having to build a sales force to achieve market penetration AMPE gets it on day 1 as this is likely to be a mandated first line therapy. Orthopedic surgeons should have no choice but to try it before they can do surgery.

The model is extremely conservative and allows investors to throw out the opiate abusers and other joint surgeries and still and get a valuation in the billions. CEO Macaluso said an appraisal was done with figures in the “ten digit area” and expects the new appraisal with the expanded label will be “multiples” of that. This means the company has gone on record with a $2 billion plus appraisal yet the market capitalization sits at $200 million roughly 10% of its potential value according to the Company.

View the complete article including the valuation gap and Investment summary with price target here: http://emerginggrowth.com/ampio-pharmaceuticals-inc-nasdaq-ampe-extended-trial-shows-patients-can-avoid-total-knee-replacement/

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies. Through its evolution, EmergingGrowth.com found a niche in identifying companies that can be overlooked by the markets due to, among other reasons, trading price or market capitalization. We look for strong management, innovation, strategy, execution, and the overall potential for long- term growth. Aside from being a trusted resource for the Emerging Growth info-seekers, we are well known for discovering undervalued companies and bringing them to the attention of the investment community. Through our parent Company, we also have the ability to facilitate road shows to present your products and services to the most influential investment banks in the space.

All information contained herein as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive. All material is for informational purposes only, is only the opinion of EmergingGrowth.com and should not be construed as an offer or solicitation to buy or sell securities. The information may include certain forward-looking statements, which may be affected by unforeseen circumstances and / or certain risks. EmergingGrowth.com has not been compensated by, any company mentioned in this article. Please read our full disclosure, which can be found here, http://emerginggrowth.com/disclosure/. Please consult an investment professional before investing in anything viewed within this article or any other portion of EmergingGrowth.com. In addition, please make sure you read and understand the Terms of Use, Privacy Policy and the Disclosure posted on the EmergingGrowth.com website.

Emerging Growth Staff

EmergingGrowth.com

305-330-1985

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.